Tesla’s (NASDAQ:TSLA) share price flew to dizzying heights in August, surpassing even the wildest expectations of many Tesla bulls. Now investors fear its valuation far exceeds the capabilities of its future vision. But one woman who held a firm belief in its ability to skyrocket, and continues to hold this view, is Cathie Wood. Founder, CEO and CIO of ARK Investment Management. Wood has a unique approach to investing and looks to the bigger picture when she makes her stock choices.

Back in 2012, she saw the writing on the wall for traditional stock plays and recognised the forthcoming changes technology was bringing to the modern world. Not in a gradual and gentle way, but in an exponentially disruptive way to infiltrate many aspects of life as we know it. In much the same way the internet has brought FAANG* stocks to the forefront of our world, Wood recognises technology is bringing about a much greater revolution that will change the face of humanity as we know it as we progress through the most transformative period in history.

To respond to this, she wanted to offer investors an opportunity to focus specifically on these areas. Unable to cater to this from her existing position, she set up ARK Investment Management in 2014. Here she began creating exchange-traded funds (ETFs) covering innovative tech plays she believes will change the world. In 2020 shareholder returns have been phenomenal and as of September 30, the firm managed approximately $30 billion in assets.

Some say she just got lucky off the back of the pandemic, low interest rates and excessive monetary stimulus; but Wood stands strong in her conviction that these areas are set to realign the future of the world. She certainly presents a compelling case. And if Wood’s disruptive innovation ethos is anything to go by, Tesla still has enormous upside potential.

So, did Wood just get lucky with her Tesla call, or does her focus on disruptive innovation, mean she’s on to something greater? Let’s look at another selection of stocks ARK has bought into and how they’ve been performing over the past 6 months.

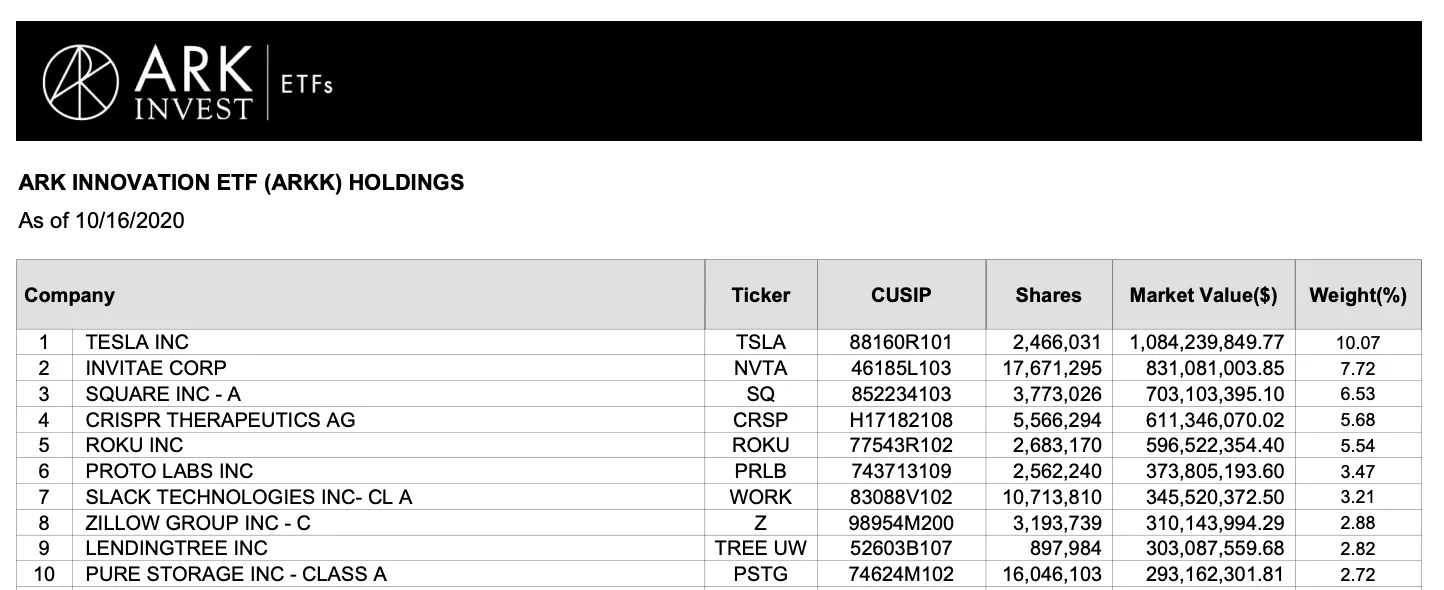

As of June 30, Tesla was ARK’s largest portfolio holding, but ARK’s next biggest holdings were InVitae Corp (NYSE: NVTA), Square Inc (NYSE: SQ), CRISPR Therapeutics AG (NASDAQ: CRSP), Roku Inc (NASDAQ: ROKU), 2U Inc (NASDAQ: TWOU), Illumina Inc (NASDAQ:ILMN) and Zillow Group Inc (NASDAQ: ZG).

ARK Invest follows the principle of Wright’s Law in guiding its research into the most lucrative stocks to buy. The premise of Wright’s Law is to forecast a decline in costs relative to an increase in production. Back in 2013 MIT researchers found Wright’s Law to be slightly more accurate than Moore’s Law. The latter predicts the number of transistors on a chip will double roughly every two years. Meanwhile, Wright’s Law proves that the doubling of production reduces cost. While Moore’s Law is based on time, Wright’s Law is based on cumulative production. This is one reason ARK is bullish on innovation, because as an industry increases its experience through scaling production, the components required will eventually come down in price, generating mass appeal and a self-fulfilling prophecy of sorts.

These businesses making up the largest sectors of ARK’s portfolio focus on technology platforms in five main sectors: artificial intelligence, energy storage, robotics, genome sequencing, and blockchain technology. Within these platforms, ARK has identified 14 technologies paving the way.

Three of ARK’s biggest holdings centre around genetic testing.

InVitae

Medical genetic testing expert’s trust. Since April 1, the InVitae share price has rocketed over 301%.

CRISPR Therapeutics

Biotech company in ARK’s portfolio. Specialising in gene editing and focused on developing transformative gene-based medicines for serious diseases. The CRISPR share price is up 185% since April 1.

Illumina

Genome sequencing company, exploring DNA at an entirely new scale. It’s Illumina’s ambition to help create the first map of gene variations associated with health, disease, and drug response.

Square

Owned by Twitter (NYSE: TWTR) founder Jack Dorsey. It’s a Fintech payment processing company that helps small businesses with credit card payments and spends little on customer acquisition compared with traditional banks. The Square share price has risen 145% in the past six months. Incidentally, Square has also just invested approximately $50 million in Bitcoin. ARK offers cryptocurrency as an alternative investment and believes cryptocurrencies governed by neutral, open source networks have the potential to win the global monetary system battle.

Square also owns Cash App, which is more accessible than traditional banks, providing numerous personal financial services. Cash App has been heavily advertised on the Joe Rogan podcast, which may have helped boost its popularity. Cash App is rolling out the option to buy fractional shares in a similar process to Robinhood. This not only makes buying stocks fast and easy, but you don’t need much money to get started. US digital wallet use is expected to exceed 220 million users by 2024, bringing $800 billion in investment opportunities in the US stock market if it brings value equal to the lifetime value of current banks’ customers.

Roku

Roku manufactures digital media players to stream content from a variety of online services. The Roku share price has risen over 220% since April 1.

2U

Powering world-class higher education online. Its function is going beyond traditional learning management systems. Using technology, data and people, it’s helping universities transform to a digital space. The 2U share price is up 51% in three months, but down 28% from its August high.

Zillow

Finally, Zillow is still an early stage company, but is already becoming a household name. Its vision is reimagining real estate to make it easier than ever to move from one home to the next. It wants to eradicate systemic racism and inequality by making home ownership and moving house, seamless and available, to anyone and everyone

Apart from these 8 companies, ARK Investment Management is invested in many more. The theme running through them is innovative technologies set to transform the world.

One of ARK’s ETFs is the ARK Innovation ETF. Its current holdings can be seen here. The poorest performer of the above stock choices is 2U, and it’s position in the top ten has been replaced with Proto Labs (NYSE: PRLB).

Image taken from Ark Invest Website

Proto Labs is a company that provides rapid manufacturing of low-volume 3D printed, CNC-machined, sheet metal, and injection-molded custom parts for prototyping and short-run production. Its target markets include manufacturers of medical devices, electronics, appliances, automotive and consumer products.

There is a great story and vision behind each of these businesses, and a genuine sense of possibility on a massive scale. It’s easy to believe in what each of them stands for and to see what Cathie Woods sees in them, but can their future wealth be guaranteed and, in turn, ours, as potential shareholders? This is the billion-dollar question. None of us know the answer, but investing involves taking an educated guess against the unknown. If you’re a long-term investor, you look to buy shares in something you believe will still be here in five or ten years’ time. This is no different. Cathie Woods firmly believes these companies, or certainly the technologies they’re working on, will still stand far into the future and through ARK she puts her money where her mouth is.

Last week on Twitter Cathie said:

“Passive investing is unlikely to keep pace with the exponential growth of the five innovation platforms and 14 technologies evolving today. In our view, S&P is depriving benchmark-sensitive investors of some of the most important investment opportunities in the world, like $TSLA.”

“Passive and benchmark-sensitive investing is contributing to the most massive misallocation of capital in history. Investing in companies because of their past successes risks putting the US at a serious competitive disadvantage to countries like China.”

These tweets convey her passion for investing heavily in future possibilities, enabled by technological advances, along with her concern for traditional investments.

The election outcome and a Covid-19 solution will give weight to what happens next. Wood merely sees the pandemic as an obstruction to a long bull run, not the end. ARK Investment Management has undoubtedly had an incredible year in response to the disruption and uncertainty caused by both, therefore shareholder returns may slow down next year, but that doesn’t mean she’ll be wrong in her predictions.

If Trump wins the election, she expects much of the same, possibly more tax breaks and the likelihood innovation and manufacturing will continue to thrive. In the event of a Biden win, taxes will be hiked and the costs for businesses will be much higher. However, she doesn’t necessarily see this as a negative for innovation because disruptive innovation (also referred to as creative destruction) tends to cut costs and streamline processes, which is what companies will be jumping on to survive.

According to Cathie Wood, in a changing economic landscape, disruptive innovation is where money will be made. It’s going to be a fascinating space to watch.

*(Facebook (NASDAQ:FB), Amazon (NASDAQ:AMZN), Apple (NASDAQ:AAPL), Netflix (NASDAQ:NFLX), and Alphabet (NASDAQ:GOOG))