When Cathie Wood founded ARK Investment Management LLC in 2014, she was known in the institutional world but largely unknown out with. And it’s highly likely she would have struggled to get airtime on CNBC, Bloomberg News, etc. Fast forward to today and she’s reached an altogether new level of fame.

money spinning ETFs Photographer: 金 运 | Source: Unsplash

During 2020, assets under management at ARK skyrocketed 978% from $3.2 billion to $34.5 billion. Thanks to regular streaming updates and appearances on many finance shows and podcasts, Wood is now recognised even when out with her family.

Now it’s the turn of Dan Ahrens, a cannabis stock investor with a big following. Dan Ahrens is a Managing Director & COO of AdvisorShares Investments, LLC. He started his AdvisorShares Pure US Cannabis ETF (NYSEARCA: MSOS) last year with $2.5 million and now has assets-under-management (AUM) of more than $1 billion. That far surpasses ARK’s impressive AUM 2020 rise and it’s getting him noticed too.

When it launched in September, this MSOS fund became the first US-listed ETF focused solely on American cannabis companies, including multi-state operators (MSOs).

AdvisorShares Pure US Cannabis ETF (NYSEARCA: MSOS) – MSOS ETF price chart

By focussing on multi-state operators, it intends to capture the big fish with profitability in mind. These are the US companies with legal approval to produce and distribute cannabis in certain states.

Dan Ahrens’ cannabis ETF invests in legal, domestically facing cannabis stocks. This gives investors access to the volatile cannabis arena with the reassurance that the ETF is largely making sensible choices.

Some of the ETFs holdings include Trulieve (OTCMKTS: TCNNF), Green Thumb (OTCMKTS: GTBIF), Curaleaf (OTCMKTS: CURLF), and TerrAscend (OTCMKTS: TRSSF).

As well as big name cannabis producers, the ETF contains cannabis-focused REITs, cannabidiol (CBD), pharmaceutical and hydroponics companies. It specifically looks for companies that make over 50% of its revenue from cannabis related business.

Cannabis production – Photographer: Richard T | Source: Unsplash

#Who is Dan Ahrens?

Dan Ahrens has worked in the financial services industry for more than twenty years. He’s held a range of senior-level positions covering many of the financial market disciplines. In addition, he has a bachelor’s in business administration in Finance from Texas Tech University.

Ahrens has also authored two books: Investing in Vice, in 2004, and Investing in Cannabis, in 2020.

Like Wood, Ahrens makes himself accessible to retail investors. He regularly appears on financial shows and podcasts. And has more recently been featured on CNBC, CNN, ABC News and Bloomberg TV as well as major publications including The Economist, New York Times, and The Wall Street Journal.

Well, about that ?. Now WSJ says it’ll come out Monday. But hey – it least I’m talking to WSJ about ??? cannabis! It should be good stuff. https://t.co/ctPSy8s0un

— InvestinginCannabis (@InvestinginCan1) March 5, 2021

Investing in Cannabis

Ahrens strongly believes in the use of ETFs as the most efficient trading vehicle for retail investors. Along with his MSOS ETF, he also manages AdvisorShares Pure Cannabis ETF (NYSEARCA: YOLO), with the comically named ticker (you only live once), and AdvisorShares Vice ETF (NYSEARCA:VICE).

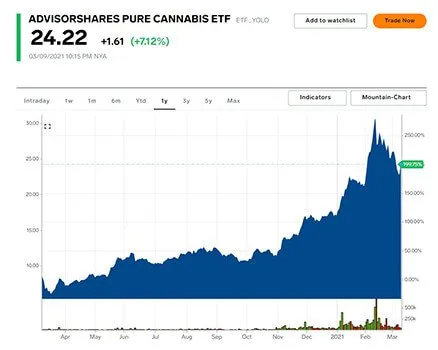

AdvisorShares Pure Cannabis ETF (NYSEARCA: YOLO) – YOLO ETF price chart

YOLO launched in 2019 and has $465 million in AUM. This ETF has a global focus whereas MSOS is domestically focused.

#Actively managed cannabis ETFs

All its ETFs are actively managed so it’s not a market cap weighted index but prefers to focus on the stocks it likes. Its cannabis ETFs don’t invest in big tobacco, alcohol, or miracle grow type products, but are pureplay cannabis funds.

It sees huge upside potential in the US cannabis market. The US market is at least 10X the Canadian market and that’s why it wants to focus on the US market. Ahrens does say he likes some Canadian names, as long as they’re profitable with strong balance sheets. But overall he prefers to focus on US undervalued stocks and to rebalance the portfolio as he sees fit.

#So, will Dan Ahrens be the next Cathie Wood?

There are clear differences between the level of notoriety Cathie Wood and Dan Ahrens are likely to achieve. Wood’s strategy is centred on the future of the world. Where we will be and how the planet will come to look, thanks to technology and the various advancements that come with it.

Ahrens, on the other hand, is focused on one niche area. He’s doing well as sentiment around the cannabis sector thrives. And it’s a sector that could continue to thrive far into the future. But it doesn’t hold promise in the way that ARK Invest’s focus on innovative disruption does.

While Ahrens could well become the Cathie Wood of the cannabis space, it seems less likely he’ll reach her level of fame and fortune.