What Rihanna’s new billionaire status means for the beauty industry

Rihanna is officially the world’s wealthiest female musician and the second richest female entertainer in the world, second only to Oprah. In fact, Barbadian singer Robyn Rihanna Fenty is now worth a staggering $1.7bn.

But it’s not her tuneful talent that got her to the dizzy heights of self-made billionaire. It’s her beauty line. Fenty Beauty contributes a whopping $1.4bn to her self-worth, and she retains a 50% stake.

What’s more, Rihanna only launched Fenty Beauty in 2017, making her fast-track route to billionaire status even more impressive.

Her 50% partner is luxury brand powerhouse LVMH Moet Hennessy Louis Vuitton (EPA: MC, BIT: LVMH).

LVMH is owned by one of the world’s wealthiest individuals Bernard Arnault.

#What makes Fenty Beauty so great?

Rihanna launched Fenty Beauty to create cosmetics tailored to skin tones often overlooked by the industry.

With inclusivity its aim, it immediately gained traction. Joining forces with LVMH proved a shrewd move as launching via such a prominent platform provided an incredible springboard to success.

Fenty Beauty products are sold online and through LVMH owned Sephora stores. Within no time, its sought-after range was outselling the Kardashian sisters’ beauty lines and the similarly-minded Honest company range run by fellow actress Jessica Alba.

#How does the Cosmetics industry fare as an investment proposition?

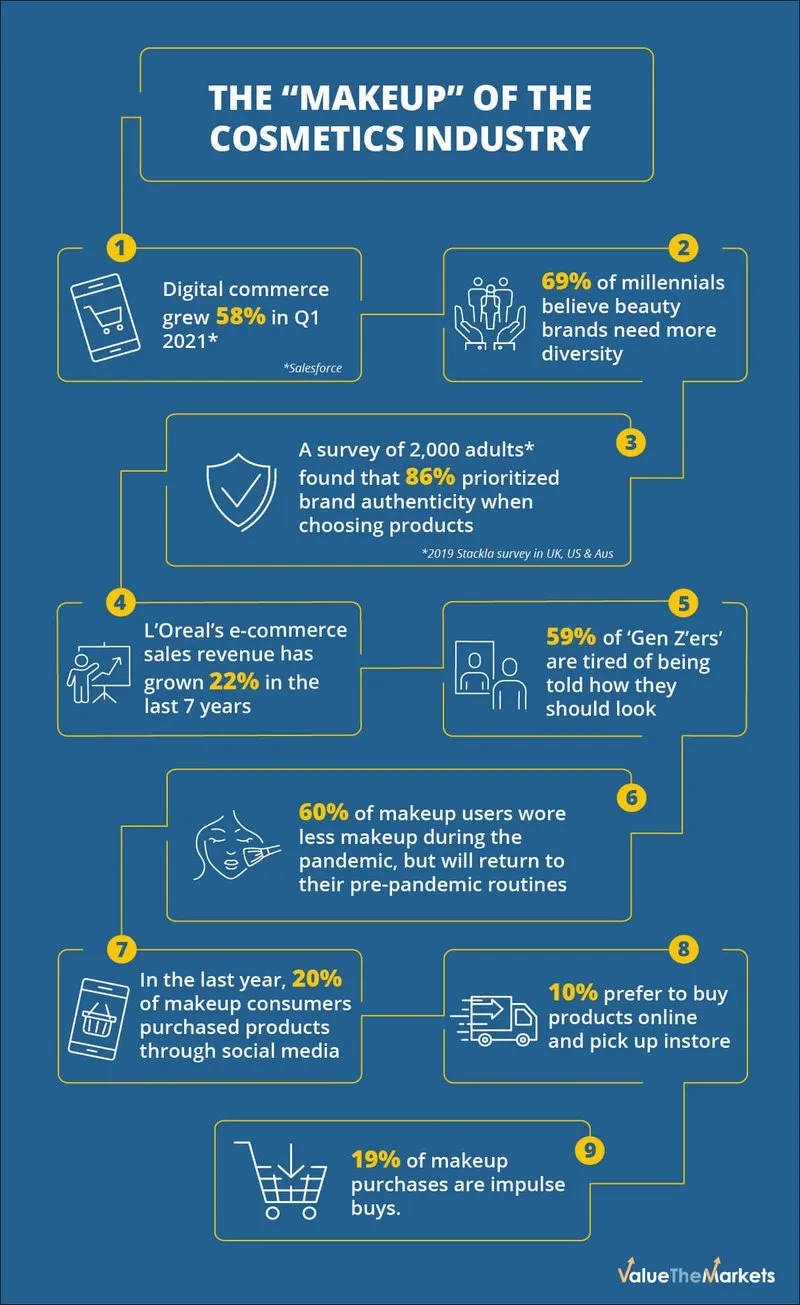

As Rihanna has shown, cosmetics are big business, and with our technologically connected world, this shows no sign of slowing down.

Looking presentable from dawn to dusk has taken on a new urgency as even children feel the pressure to be selfie-ready.

Cashing in on vanity goes back to the eighteenth century and is now one of the most profitable industries on the planet.

According to Allied Market Research, the global cosmetics market size is projected to reach $463.5bn by 2027, registering a compound annual growth rate (CAGR) of 5.3% between now and then.

Lifestyle changes, such as working from home change the nature of skincare and beauty routines.

Mask wearing could reduce the amount of make-up being worn by some, while an increase in face-to-face virtual meetings could increase makeup consumption for others.

Meanwhile, the acceleration in digitalisation and e-commerce is bringing more opportunities to the sector.

#Cosmetics industry deep dive

Fenty Beauty is a privately held company, but to access it, you could buy shares in LVMH.

#LVMH

LVMH Moet Hennessy Louis Vuitton (EPA: MC) Is a luxury products company selling world-famous champagnes, wines, and spirits including Dom Pérignon, Glenmorangie, Hennessy, Krug, Mercier, Moët & Chandon, Veuve Clicquot, as well as some of the world’s most prestigious fashion labels such as Christian Dior and Gucci. In addition to Fenty Beauty, it also sells many illustrious beauty brands such as Benefit Cosmetics and Guerlain.

LVMH has a €353bn market cap, total debt is €38bn, while cash and equivalents are €8.7bn. Meanwhile, the short interest on this stock is negligible.

LVMH has a forward P/E of 33. It also offers shareholders a 0.85% dividend yield.

Analyst consensus on this stock is a 12-month average share price target of €734.79. That gives a potential 4.7% upside.

LVMH stock appears in 98 exchange-traded funds (ETFs).

#Estée Lauder Companies Inc

Estée Lauder Companies Inc. (NYSE: EL) manufactures and markets skincare, makeup, fragrance, and hair care products.

EL has a $118bn market cap, total debt is $8.5bn, while cash and equivalents are $6.4bn. Meanwhile, the short interest on this stock is 0.5%.

Estée Lauder has a forward P/E of 47. It also offers shareholders a 0.65% dividend yield.

EL displays EPS growth of 8% TTM, and its 2021 consensus average EPS forecast is $6.18.

Analyst consensus on this stock is a 12-month average share price target of $341.13. That gives a potential 4% upside.

EL stock appears in 191 exchange-traded funds (ETFs).

In the past year, Estee Lauder has navigated the shift from physical retail to e-commerce. It has embraced the virtual and tech worlds by implementing virtual try-ons and connecting beauty experts with consumers in real-time via social media.

All in all, Estée Lauder appears to have its finger on the pulse.

#L’Oreal

L’Oreal (EPA: OR) is the world’s largest beauty company. The French conglomerate includes subsidiaries Maybelline, Kiehl’s, and NYX.

OR stock has a €222bn market cap, total debt is €2.4bn, while cash and equivalents are €4.8bn.

L’Oreal has a forward P/E of 44. It also offers shareholders a 1% dividend yield.

OR displays an estimated long-term growth rate of 10.6%, and its 2021 consensus average EPS forecast is €8.43.

Analyst consensus on this stock is a 12-month average share price target of €376.85. That gives a bearish average with a 4.5% downside.

OR stock appears in 112 exchange-traded funds (ETFs).

For long-term shareholders, L’Oreal offers a loyalty bonus of 10%. This bonus is paid on your dividend income after two years or more as a shareholder.

#COTY

COTY (NYSE: COTY) manufactures and distributes cosmetics and beauty products worldwide. It is also the global leader in fragrances. Rimmel, Bourjois, Max Factor, and Sally Hansen all come under the COTY banner.

In recent news, COTY is rolling out digitally-enabled touch-less fragrance testing devices to allow consumers to sample new perfumes in a post-covid world. French start-up Everie is behind the innovation, and these smart devices will also serve real-time data to retailers to help them optimize in-store positioning and customer experience.

In June it relaunched Kylie Cosmetics with new and improved clean and vegan formulas.

COTY has a $6.4bn market cap, total debt is $5.74bn, while cash and equivalents are $315m. Meanwhile, the short interest on this stock is 2.2%.

COTY has a forward P/E of 71.8. The cosmetics giant doesn’t offer shareholders a dividend.

Analyst consensus on this stock is a 12-month average share price target of $10.26. That gives a potential 20% upside.

COTY stock appears in 82 exchange-traded funds (ETFs).

All-in-all, COTY is a global powerhouse with a lot to like. Nevertheless, its forward P/E is high, as is its debt.

#Nu Skin Enterprises

Nu Skin Enterprises (NYSE: NUS) develops and distributes personal care and wellness products worldwide.

NUS stock has a $2.7bn market cap, total debt is $587m, while cash and equivalents are $379m. Meanwhile, the short interest on this stock is 4.8%.

Nu Skin Enterprises has a forward P/E of 11. It also offers shareholders a 2.8% dividend yield.

NUS stock displays an estimated long-term growth rate of 6.8%, and its 2021 consensus average EPS forecast is $4.41.

Analyst consensus on this stock is a 12-month average share price target of $64.20. That gives a potential 19.6% upside.

NUS stock appears in 128 exchange-traded funds (ETFs).

#Revlon

Revlon (NYSE: REV) is a famous American beauty line selling brands like Elizabeth Arden and Cutex.

REV has a $610m market cap, total debt is $3.3bn, while cash and equivalents are $85m. Meanwhile, the short interest on this stock is 3%.

REV has been displaying negative revenue growth for the past three years.

Analysts are bearish on the stock with a 12-month average share price target of $11, around 8% lower than today.

REV stock appears in 21 exchange-traded funds (ETFs).

Not all beauty brands are a good investment. Revlon is struggling under a pile of debt which makes it a riskier play.

Nevertheless, its Q2 revenues beat market expectations, and it does enjoy revenue of nearly £1.5bn.

Revlon has been subject to the ‘short squeeze’ treatment by meme stock traders this year.

#THG

The Hut Group (LON: THG) in London has grown its hot beauty brands portfolio. THG operates a popular beauty box subscription business, and its latest acquisition is Cult Beauty.

THG has a £6.5bn market cap. It launched publicly via IPO last year and has an aggressive approach to scale.

Analyst consensus on this stock sees a potential 46% upside on the current share price.

THG stock appears in 27 exchange-traded funds (ETFs).

#MAV Beauty Brands Inc

MAV Beauty Brands (TSX: MAV) is a small Canadian company operating in the global beauty industry.

MAV has a $143m market cap, total debt is $184m, while cash and equivalents are $22.8m.

MAV Beauty Brands has a forward P/E of 7.

MAV has an estimated long-term growth rate of 34%, and its 2021 consensus average EPS forecast is $0.37.

Analyst consensus on this stock is a 12-month average share price target of $4.55. That gives a potential 44% upside.

MAV stock appears in 1 ETF.

There are many more potential beauty industry investments to consider. Ulta Beauty (NASDAQ: ULTA), E.L.F Beauty Inc (NYSE: ELF), The Honest Company (NASDAQ: HNST), Edgewell Personal Care Company (NYSE: EPC), Kao Corporation (OTCMKTS: KAOOY), and The Procter and Gamble Company (NYSE: PG), to name a few.

#Private Equity likes the beauty sector

The profitability of the beauty sector hasn’t gone unnoticed in Private Equity.

In April, Carlyle Group took a significant stake in US direct-to-consumer start-up Beautycounter. This deal gave the parent company of the clean cosmetics innovator a $1bn valuation and unicorn status.

Last year, Spanish firm Puig bought a majority stake in Britain’s iconic luxury makeup and skincare brand Charlotte Tilbury. It followed this by purchasing Derma in January 2021.

More recently, American PE firm KKR acquired a majority stake in Vini Cosmetics, a leading Indian beauty products company. It reported that KKR paid $625m for a 55% stake, thus giving Vini Cosmetics a $1.1bn valuation.

Meanwhile, AUA Private Equity Partners has established Profectus Beauty to invest in Hispanic beauty firms.

There are also side industries springing up. Finnish start-up Innomost raised €5m to expand its birch bark sustainable ingredient business to new markets. This is touted as an environmentally friendly alternative to palm oil, fossil fuels, and food-origin ingredients.

#The beauty industry is vast but hugely competitive.

Specialty beauty faced challenges at the height of the pandemic but is bouncing back nicely as pent-up demand is strong.

According to research group NPD, Q2 2021 sales of US prestige beauty products almost reached $4.9bn, up 66% year-over-year and a 6% rise on Q2 2019. Makeup sales led the way, followed by Skincare, Fragrance, and Haircare.

Recent years have seen a trend shift in the beauty industry as climate change initiatives drive transparency and equality drives inclusivity. These USPs are tailor-made for influencers across social media, channeling the narratives.

Meanwhile, the big brands and savvy start-ups are pedaling an abundance of new lines complete with clearer product labeling and natural ingredients.

The pandemic accelerated the shift to e-commerce, and many mainstream beauty majors have seen their share prices soar. While this is great news for shareholders, analysts are divided on whether the party can last.

With beauty start-ups achieving outsized valuations in record time, it seems the trend may be heading for a steep fall.

Indeed, many of these companies sport exceptionally high price-to-earnings ratios, which could prove challenging to reduce. However, the top dogs are no strangers to M&A, and in a world where the strong get stronger, it seems betting on the leaders may prove the winning strategy.