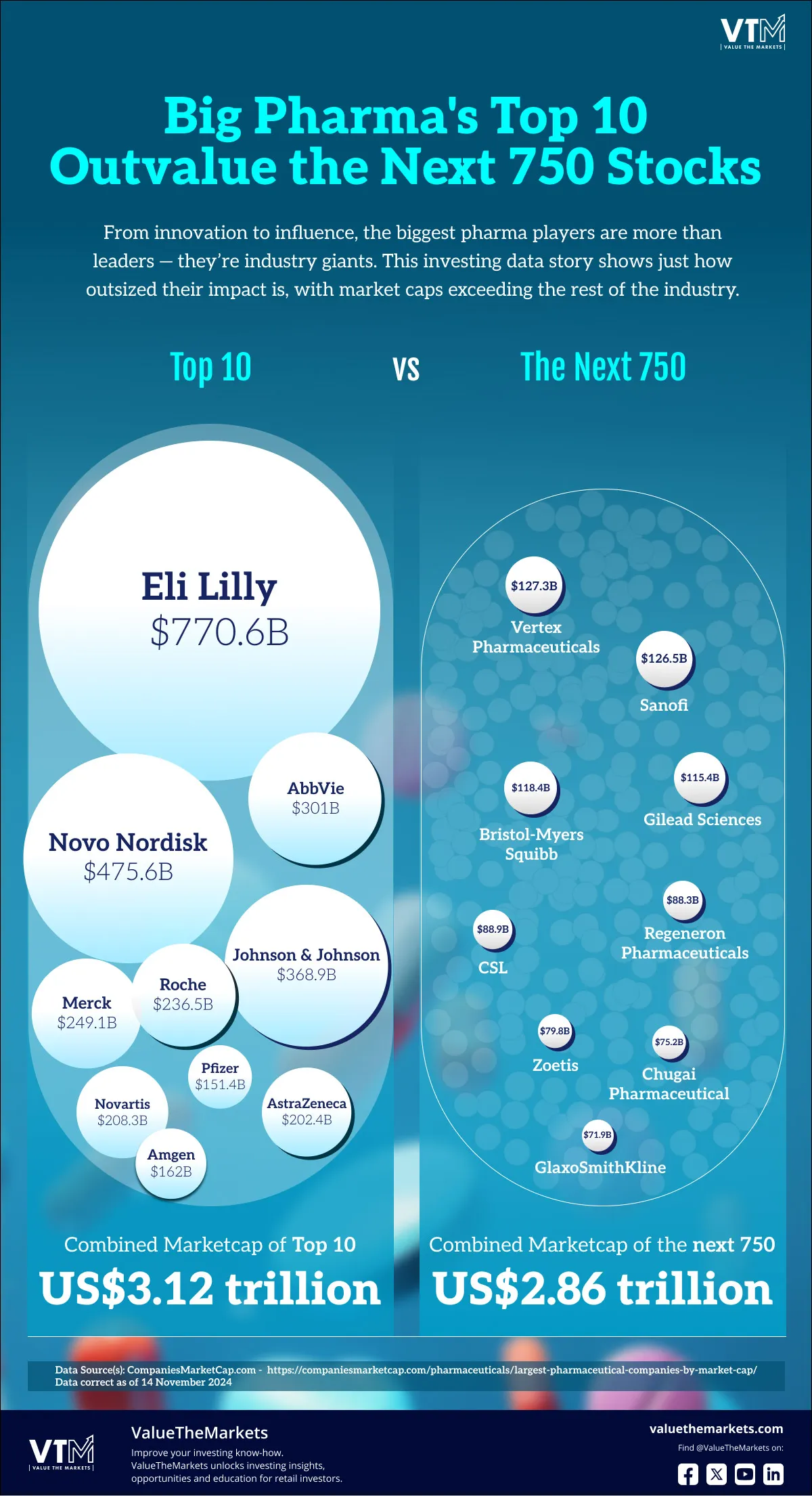

The top 10 pharmaceutical companies globally, including Eli Lilly (NYSE: LLY), Novo Nordisk (NYSE: NVO), and Johnson & Johnson (NYSE: JNJ), collectively hold a market cap of $3.12 trillion. This staggering figure eclipses the combined market cap of the next 750 companies by $260 billion. This dominance underscores their pivotal role in shaping the future of healthcare and driving the pharmaceutical industry forward.

Leaders like Roche (OTC: RHHBY), Pfizer (NYSE: PFE), and AstraZeneca (NASDAQ: AZN) leverage vast resources to develop cutting-edge therapies, from gene editing to personalized medicine. In contrast, smaller companies often focus on niche innovations, a dynamic that positions the top 10 as pioneers in delivering breakthrough advancements.

Their immense scale provides unmatched advantages in research and development, global market access, and strategic agility. With valuations exceeding the rest of the industry, these giants set the pace for innovation, mergers, healthcare policies, and pricing trends.

Meanwhile, the next 750 companies, including notable players like Vertex Pharma (NASDAQ: VRTX) and Sanofi (NASDAQ: SNY), collectively hold a market cap of $2.86 trillion. However, their fragmentation limits their ability to match the outsized impact of the industry’s top 10 leaders.

#United for the Greater Good

The pandemic spurred unprecedented collaboration between pharmaceutical companies and governments, paving the way for faster clinical trials and streamlined regulatory approvals. This momentum is evident in groundbreaking advancements like mRNA technology repurposed for cancer treatments and other infectious diseases. Universally impactful drugs, such as semaglutide (Novo Nordisk’s Wegovy) and tirzepatide (Eli Lilly’s Zepbound) for tackling weight loss, also stand out. These medications target widespread health issues rather than niche markets, aligning with the trend toward more universally impactful treatments.

The development of these weight loss drugs involved repurposing existing diabetes treatments. This process included significant public-private collaborations, such as regulatory fast-tracking. For instance, the U.S. FDA granted Fast Track designation to tirzepatide for treating adults with obesity or overweight with weight-related comorbidities1.

The momentum gained during the pandemic has led to faster clinical trials, more streamlined regulatory processes, and an increasing openness to innovation, particularly for treatments that address chronic health problems affecting large populations. Artificial intelligence in drug discovery, digital health, and precision medicine are emerging trends that are also expected to help accelerate new treatments.

Today, the top 10 pharmaceutical giants are releasing potentially practice-changing datasets for lung cancer, multiple sclerosis, and other high-impact diseases. These advancements not only keep them at the forefront of medical innovation but also demonstrate why they command such a significant market valuation, compounded by their ability to consistently deliver game-changing therapies.

#Investing in Pharma

Retail investors looking to capitalize on the pharmaceutical sector's growth may consider exchange-traded funds (ETFs) like the Health Care Select Sector SPDR Fund (XLV) or iShares U.S. Pharmaceuticals ETF (IHE). These ETFs provide broad exposure to top pharma companies while diversifying risk. For those willing to delve into individual equities, fractional share platforms allow investments in the top 10 giants without committing large sums. Learn how to find new and interesting investment opportunities.

The top 10 pharmaceutical companies are well-established and typically provide a dividend yield, offering steady income and encouraging investor confidence during market downturns.

Investors seeking higher-risk, higher-reward opportunities might also consider biotech companies that could become acquisition targets for larger players. It’s also possible that mid-sized or emerging players could disrupt the market. For instance, biopharma companies are at the forefront of scientific discovery, leveraging advanced technologies like gene editing, mRNA platforms, and immunotherapy to address unmet medical needs.

#Challenges Facing Pharma Giants

Although big pharma faces several challenges, its extensive resources, strategic partnerships, and global reach position the top 10 companies to address these obstacles more effectively than their smaller competitors.

Patent Expiry

Major companies such as Johnson & Johnson, Roche, and Pfizer face challenges from patent expirations as blockbuster drugs lose exclusivity. For example, Stelara’s U.S. patent expired in 2023, but J&J secured agreements to delay biosimilar competition until 20252. Patents for Roche’s top-selling multiple sclerosis drug Ocrevus will start to expire in Europe in 2028 and the US in 20293. Meanwhile, Novartis lost its initial attempt to block a generic version of Entresto, its top-selling heart medication4.

With patent expirations posing significant challenges, major players are employing patient-switching strategies and preparing for biosimilar competition to maintain market relevance. Patient switching is when pharmaceutical companies transition patients from a soon-to-be generic drug to a newer, patented version or a next-generation product to retain market share and minimize revenue loss when the original drug loses patent exclusivity.

Their adaptability highlights why these pharmaceutical giants can maintain their massive market cap compared to smaller firms, which often struggle to cope with the revenue impact from patent cliffs.

Currency Fluctuations

Non-dollar reporting companies among the top 10, like GSK, Roche, and Novo Nordisk, benefit from recent US dollar strength, which helps bolster their financial performance on a global stage. This financial stability is another reason these companies maintain such a vast market cap compared to smaller firms, which may struggle with currency volatility.

Drug Pricing

Drug pricing negotiations, particularly in the United States, pose a significant challenge for pharmaceutical companies. Recent regulatory reforms, such as Medicare's ability to negotiate prices for certain drugs5, are expected to pressure revenue streams for the top players. However, the scale and resources of companies like Pfizer, Roche, and Johnson & Johnson allow them to adapt by focusing on high-margin therapies, optimizing R&D pipelines, and leveraging global markets to offset potential pricing constraints.

Navigating Chinese Market Challenges

Companies like Roche, GSK, and AstraZeneca are managing economic pressures and anti-corruption challenges in China6, a key growth market. Their continued presence and strategic maneuvers in a challenging market environment underline their ability to absorb macroeconomic shocks better than smaller competitors, further justifying their leadership status.

#Growth Through M&A

The leading players in pharma are well-positioned to mitigate potential losses through mergers, acquisitions (M&A), and in-licensing strategies. By targeting early-stage biotech innovations, strategic acquisitions help these companies expand their pipelines and sustain long-term growth. This stands in stark contrast to smaller firms, which often lack the resources to execute aggressive M&A or in-licensing activities, leaving their pipelines more vulnerable.

Meanwhile, companies like Sanofi and Novartis are divesting noncore assets, including consumer health divisions, to sharpen their focus on high-margin pharmaceutical operations. For instance, Sanofi’s sale of its Opella stake7 and Novartis’s spin-off of Sandoz8 demonstrate a shift toward streamlining operations, boosting profitability, and reinvesting in growth areas. Smaller firms typically lack the flexibility to make such transformative moves. This adaptability positions top-tier pharma companies to secure their leading valuations and strengthen their competitive edge.

#Pharma Titans of the Future

The infographic highlights the dominance of the top 10 pharmaceutical companies, underscored by their unparalleled market influence and innovative capabilities. With a combined market cap of $3.12 trillion9, these giants not only drive the pace of medical advancements but also set industry standards in R&D, M&A, and global market strategies. While challenges such as patent expirations, regulatory reforms, and geopolitical risks persist, their financial strength, diversified portfolios, and strategic adaptability ensure they remain resilient and competitive.

Of course, there are no guarantees the current 10 companies will remain the dominant ten. They are not immune to sector-wide disruptions, including biosimilar competition, pipeline setbacks, and evolving global healthcare policies. Their market dominance and pricing power, while critical to their success, can attract regulatory scrutiny and public debate over drug affordability, posing additional risks to their long-term growth strategies.

For retail investors, the infographic provides a clear snapshot of the scale and opportunities within the sector, offering insights into both the stability of established leaders and the growth potential of emerging players.

Sources

Eli Lilly and Company. Lilly Receives U.S. FDA Fast Track Designation for Tirzepatide. 2024. https://investor.lilly.com/news-releases/news-release-details/lilly-receives-us-fda-fast-track-designation-tirzepatide

Reuters. Alvotech Settles with J&J to Launch Stelara Biosimilar in Europe, Canada. February 15, 2024. https://www.reuters.com/business/healthcare-pharmaceuticals/alvotech-settles-with-jj-launch-stelara-biosimilar-europe-canada-2024-02-15/

GlobalData. Multiple Sclerosis Market to Generate Sales of $29.8 Billion by 2030. April 18, 2023. https://www.globaldata.com/media/pharma/multiple-sclerosis-market-generate-sales-29-8-billion-2030-forecasts-globaldata/)

Reuters. Novartis Loses Initial Bid to Block Generic of Best-Selling Heart Drug. August 12, 2024. https://www.reuters.com/business/healthcare-pharmaceuticals/novartis-loses-initial-bid-block-generic-best-selling-heart-drug-2024-08-12/

U.S. Department of Health and Human Services. HHS Selects the First Drugs for Medicare Drug Price Negotiation. August 29, 2023. https://www.hhs.gov/about/news/2023/08/29/hhs-selects-the-first-drugs-for-medicare-drug-price-negotiation.html

The Guardian. AstraZeneca Says It Takes China Investigation 'Very Seriously'. November 12, 2024. https://www.theguardian.com/business/2024/nov/12/astrazeneca-china-investigation-pharmaceutical-profit-us

Financial Times. AstraZeneca Faces Scrutiny Over China Operations. November 12, 2024. https://www.ft.com/content/b83157a6-08c4-4dc1-a5f6-3f5ebafb42c4

Novartis. Novartis Executes Sandoz Spin-Off, Completing Strategic Transformation into a Leading, Focused Innovative Medicines Company. October 4, 2023. https://www.novartis.com/news/media-releases/novartis-executes-sandoz-spin-completing-strategic-transformation-leading-focused-innovative-medicines-company

CompaniesMarketCap.com. Largest Pharmaceutical Companies by Market Cap. November 2024. https://companiesmarketcap.com/pharmaceuticals/largest-pharmaceutical-companies-by-market-cap/