Disseminated on behalf of Graphite One Inc ValueTheMarkets, a trading name of Digitonic Ltd., was compensated by Graphite One Inc fifty thousand US dollars per month for a 12-month period starting 24 April 2024 until 23 April 2025 to produce and disseminate this. Digitonic Ltd. does not own a position in Graphite One Inc

Graphite One is Powering Tech Innovation. Learn More!

Materials

Graphite One Inc | Listed on: TSX-V: GPH | OTCQX: GPHOF

Graphite is intrinsic to many modern and green transition technologies. Counted among the official US Government-listed Critical Minerals¹, graphite is seeing market demand increase significantly. Graphite One Inc (TSX-V: GPH) (OTCQX: GPHOF) is a company readily embracing the opportunity to tap into this demand growth. Read on for key insights into the strategic moves this growth-centric graphite stock is making now.

About Graphite One (G1)

Graphite One Inc. (G1) (TSX-V: GPH) (OTCQX: GPHOF) aims to become a significant player in the US graphite space and is developing an all-American battery materials supply chain solution around this critical material. In Alaska, G1’s Graphite Creek project boasts the largest natural flake graphite deposit in the US². Spanning 176 mining claims covering more than 23.6K acres³, the United States Geological Survey (USGS) said it is among the largest graphite deposits in the world².

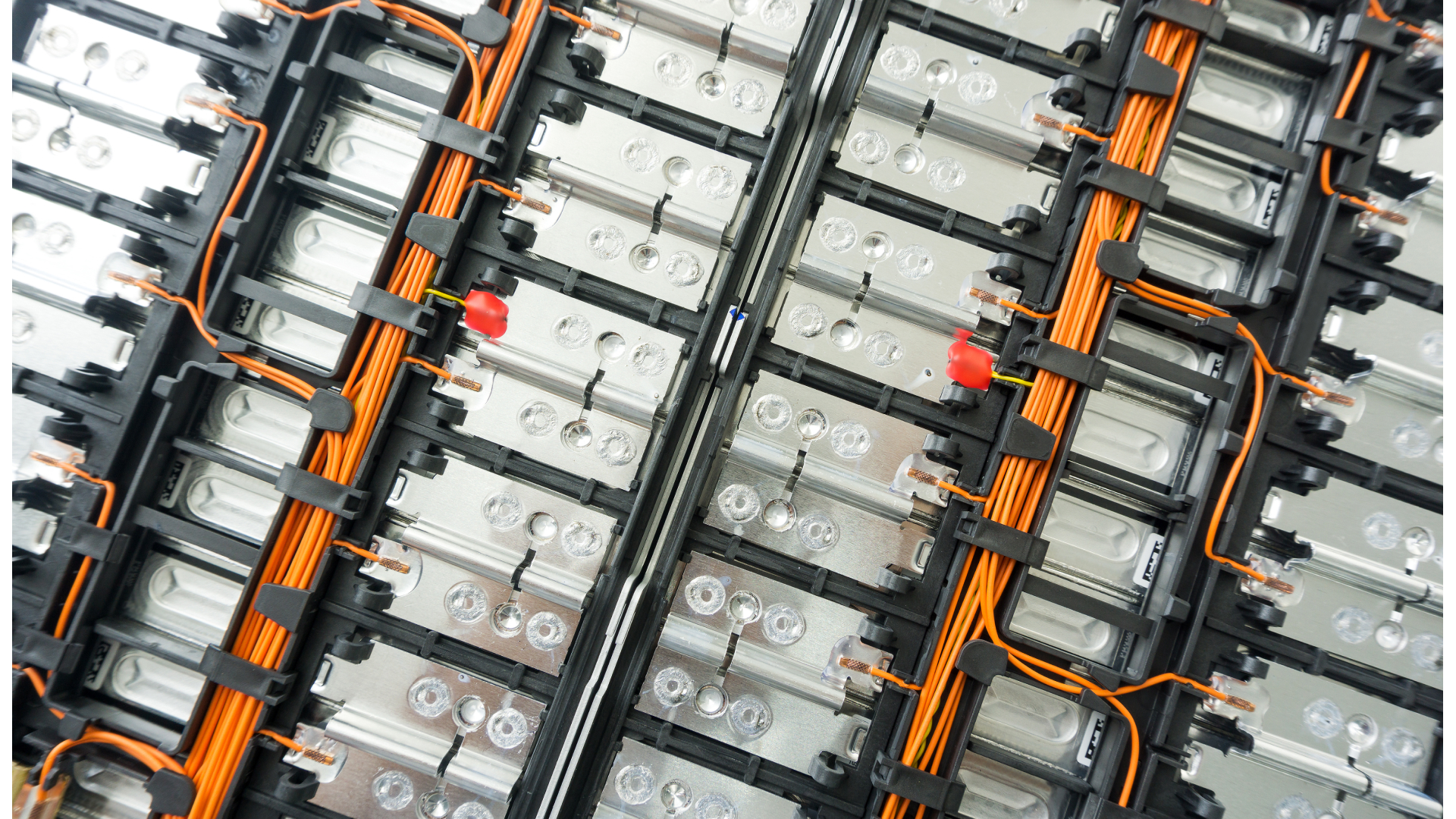

This potentially lucrative property forms the basis of G1's goal of producing anode material for the lithium-ion electric vehicle battery market, energy storage systems and other graphite applications.

G1 is also laying the groundwork for an advanced graphite anode manufacturing plant in Ohio, which is to be accompanied later by a battery materials recycling facility. Ultimately, the company has ambitious plans to become the first vertically integrated graphite producer to serve the US EV battery market.

The powerful backing of the United States Government validates G1's strategy. That’s because Graphite One has received two substantial Department of Defense (DoD) grants amounting to $42.2M. This includes $37.5M for a feasibility study⁴ and $4.7M for developing a graphite-based foam fire suppressant⁵. Better still, substantial Federal support for the industry continues, which G1 plans to continue to tap into.

As Graphite One moves from development to full-scale production, it aims to reduce the US dependency on China for graphite and secure a robust and sustainable American graphite supply. Headed up by an exceptional management team, who are experts in mine construction, process design, and operations, G1 is committed to rigorous cost controls and efficiencies to maximize profitability and stakeholder value.

Why Invest in Graphite One

-

Mission to Lead the US Graphite Supply Chain

With three planned integrated operational pillars, G1 is on a mission to become a significant player in the US graphite supply chain as its future plans are to mine, process, manufacture, and recycle graphite anode materials. It is anticipated that this will primarily supply the US lithium-ion EV battery market and energy storage systems.

-

Security of Supply

The US is 100% reliant on imports of natural graphite, with around 70%⁶ coming from China. As the US intensifies efforts to challenge China's graphite market dominance, G1 is establishing the business and connections necessary to enhance supply chain security and economic competitiveness.

-

Dedicated to Lasting Success

G1 has assembled a team of individuals who are not just capable but are ready to drive business growth and deliver enduring value to stakeholders over the long term. G1’s management team excels in mine construction, process control design, and facility management. Their extensive expertise ensures efficient operations and a commitment to cost efficiency to maximize profitability.

-

Surging Market Demand

Rapid EV market growth is fueling a surging demand for graphite. The World Bank Group⁷ projects a 494% increase in the graphite market by 2050, while Joe Biden's 100-day report anticipates a 2,500% surge⁸ in graphite demand by 2040. G1's Graphite Creek is anticipated to meet escalating material needs while enabling the technology revolution in the green transition. Graphite One is planning to support technological advancements in sustainable energy.

-

A Key Material for the Tech Revolution

Graphite is a critical element in the making of lithium-ion batteries which power a wide range of modern technologies from smartphones to electric vehicles (EVs). It is also used in multiple military applications and as a foundation for graphene production.

-

Government Funding Boosts Investor Confidence

Government funding and investments by local and indigenous communities underscore investor confidence in Graphite One's strategy. Department of Defense (DoD) grants and Bering Strait Native Corporation’s investment validate company initiatives. Taiga Mining's investment further highlights trust in G1’s mining projects.

The Versatile Role of Graphite in Powering Technology and Defense

Graphite is a key component in numerous high-tech and energy applications, particularly lithium-ion batteries. Its superior conductivity, thermal stability, and chemical resistance improve the efficiency and lifespan of batteries that power various devices and vehicles, from smartphones and laptops to electric vehicles (EVs) and energy storage systems.

EV sales are rising worldwide, with China taking the lead in 2023, igniting growing demand for graphite. In fact, graphite demand is projected to increase by 2,500% by 2040⁶.

Beyond energy storage, graphite is instrumental in the production of graphene. This material boasts exceptional strength, flexibility, and conductivity, making it highly useful in electronics, medical devices, and composite materials.

Graphite is also essential to the defense industry. Its ability to tolerate high temperatures, resist corrosion, and shield against electromagnetic detection gives it a high degree of worth in military applications. Graphite is used when constructing fighter aircraft, tanks, submarines, drones and more. With international tensions escalating, graphite demand from the military sector is also expected to rise.

Enabling the Tech Revolution with Vertical Integration

With the largest natural flake graphite deposit in the United States², Graphite One is in a prime position to strengthen the country's clean energy and tech sectors with access to a stable supply of high-quality graphite.

The company plans to manage the entire production cycle, from graphite extraction at Graphite Creek to manufacturing battery anodes and recycling used materials in Ohio. This vertical integration should ensure high-quality production, reduce reliance on imports, and uphold strict environmental standards.

Central to its business model, this approach meets the world’s increasing demand for critical materials and promotes domestic sustainability and economic growth in America. Better still, G1 has notable backing from the DoD, strong political endorsement, and a significant investment from the Bering Straits Native Corporation (BSNC). This support validates Graphite One as a viable business and a graphite stock worth considering.

Enabling the Tech Revolution with Vertical Integration

With the largest natural flake graphite deposit in the United States², Graphite One is in a prime position to strengthen the country's clean energy and tech sectors with access to a stable supply of high-quality graphite.

The company plans to manage the entire production cycle, from graphite extraction at Graphite Creek to manufacturing battery anodes and recycling used materials in Ohio. This vertical integration should ensure high-quality production, reduce reliance on imports, and uphold strict environmental standards.

Central to its business model, this approach meets the world’s increasing demand for critical materials and promotes domestic sustainability and economic growth in America. Better still, G1 has notable backing from the DoD, strong political endorsement, and a significant investment from the Bering Straits Native Corporation (BSNC). This support validates Graphite One as a viable business and a graphite stock worth considering.

Investing in Battery Metals

If you are looking to invest in EV batteries then a graphite stock makes an interesting twist on a traditional EV investment. Investing in battery metals production, rather than the finished product, is a less mainstream approach.

By focusing on graphite stocks, investors can tap into the essential elements that power EVs and other high-tech devices. This strategy diversifies investment portfolios and provides exposure to a critical resource driving the clean energy transition.

As demand for electric vehicles and renewable energy solutions continues to soar, graphite plays a pivotal role in supplying the necessary materials for these industries, making it a strategic investment choice.

Read our detailed report on Graphite One for all the information you need on this exciting business operating in the US graphite market.

Explore This Pioneering Growth Stock's Potential

Graphite One is harnessing the US graphite opportunity from multiple angles. By taking an integrated approach, G1 is positioning itself with the goal of becoming a key player in the technology revolution. Thus, strategically ensuring its long-term viability while aiming to attain a competitive edge in the market. Its proposed triple-linked integration strategy is designed to cement the company's role as a vital part of the future of graphite-based technology in the United States.

Important Notice And Disclaimer

PAID ADVERTISEMENT

This communication is a paid advertisement. ValueTheMarkets is a trading name of Digitonic Ltd, and its owners, directors, officers, employees, affiliates, agents and assigns (collectively the “Publisher”) is often paid by one or more of the profiled companies or a third party to disseminate these types of communications. In this case, the Publisher has been compensated by Graphite One Inc. to conduct investor awareness advertising and marketing and has paid the Publisher the equivalent of fifty thousand US dollars per month for a 12-month period starting 24 April 2024 until 23 April 2025 to produce and disseminate this and other similar articles and certain related banner advertisements. This compensation should be viewed as a major conflict with the Publisher’s ability to provide unbiased information or opinion.

CHANGES IN SHARE TRADING AND PRICE

Readers should beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you receive this communication, which has the potential to adversely affect share prices. Frequently companies profiled in our articles experience a large increase in share trading volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in share trading volume and share price may likely occur.

NO OFFER TO SELL OR BUY SECURITIES

This communication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security.

INFORMATION

Neither this communication nor the Publisher purport to provide a complete analysis of any company or its financial position.

This communication is based on information generally available to the public and on an interview conducted with the company’s CEO, and does not contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, the Publisher does not guarantee the accuracy or completeness of the information. Further, the information in this communication is not updated after publication and may become inaccurate or outdated. No reliance should be placed on the price or statistics information and no responsibility or liability is accepted for any error or inaccuracy. Any statements made should not be taken as an endorsement of analyst views.

NO FINANCIAL ADVICE

The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser or a financial adviser. The Publisher has no access to non-public information about publicly traded companies. The information provided is general and impersonal, and is not tailored to any particular individual’s financial situation or investment objective(s) and this communication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor or a personal recommendation to deal or invest in any particular company or product. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the advertised company’s SEC, SEDAR+ and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk. Past performance does not guarantee future results.

FORWARD LOOKING STATEMENTS

This communication contains forward-looking statements, including statements regarding expected continual growth of the featured companies and/or industry. Statements in this communication that look forward in time, which include everything other than historical information, are based on assumptions and estimates by our content providers and involve risks and uncertainties that may affect the profiled company’s actual results of operations. These statements involve known and unknown risks, uncertainties and other important factors that could cause the actual results and performance to differ materially from any future results or performance expressed or implied in the forward-looking statements. These risks, uncertainties and other factors include, among others: the success of the profiled company’s operations; the size and growth of the market for the company’s products and services; the company’s ability to fund its capital requirements in the near term and long term; pricing pressures; changes in business strategy, practices or customer relationships; general worldwide economic and business conditions; currency exchange and interest rate fluctuations; government, statutory, regulatory or administrative initiatives affecting the company’s business.

INDEMNIFICATION/RELEASE OF LIABILITY

By reading this communication, you acknowledge that you have read and understand this disclaimer in full, and agree and accept that the Publisher provides no warranty in respect of the communication or the profiled company and accepts no liability whatsoever. You acknowledge and accept this disclaimer and that, to the greatest extent permitted under applicable law, you release and hold harmless the Publisher from any and all liability, damages, injury and adverse consequences arising from your use of this communication. You further agree that you are solely responsible for any financial outcome related to or arising from your investment decisions.

TERMS OF USE AND DISCLAIMER

By reading this communication you agree that you have reviewed and fully agree to the Terms of Use found here https://www.valuethemarkets.com/terms-conditions/ and acknowledge that you have reviewed the Disclaimer found here https://www.valuethemarkets.com/disclaimer/. If you do not agree to the Terms of Use, please contact valuethemarkets.com to discontinue receiving future communications.

INTELLECTUAL PROPERTY

All trademarks used in this communication are the property of their respective trademark holders. Other than valuethemarkets.com, the Publisher is not affiliated, connected, or associated with, and the communication is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks other than valuethemarkets.com.

AUTHORS: VALUETHEMARKETS

valuethemarkets.com and Digitonic Ltd and our affiliates are not responsible for the content or accuracy of this article. The information included in this article is based solely on information provided by the company or companies mentioned above. This article does not provide any financial advice and is not a recommendation to deal in any securities or product. News and research are not recommendations to deal, and investments may fall in value so that you could lose some or all of your investment. Past performance is not an indicator of future performance.

ValueTheMarkets do not hold any position in the stock(s) and/or financial instrument(s) mentioned in the above piece. ValueTheMarkets have been paid to produce this piece by the company or companies mentioned above. Digitonic Ltd, the owner of valuethemarkets.com, has been paid for the production of this piece by the company or companies mentioned above.