Clarity Gold Corp. (CSE:CLAR | PINK:CLGCF)

Clarity Gold Corp focusses on the acquisition and exploration of overlooked and under-financed gold properties. It’s a junior gold company taking the uncertainty out of exploring and diving in with clarity of vision. With that in mind, it pounces on shiny gold opportunities in an effort to handsomely reward shareholders for their commitment and loyalty.

#Clarity Gold’s 6km Acquisition in a Prime Location

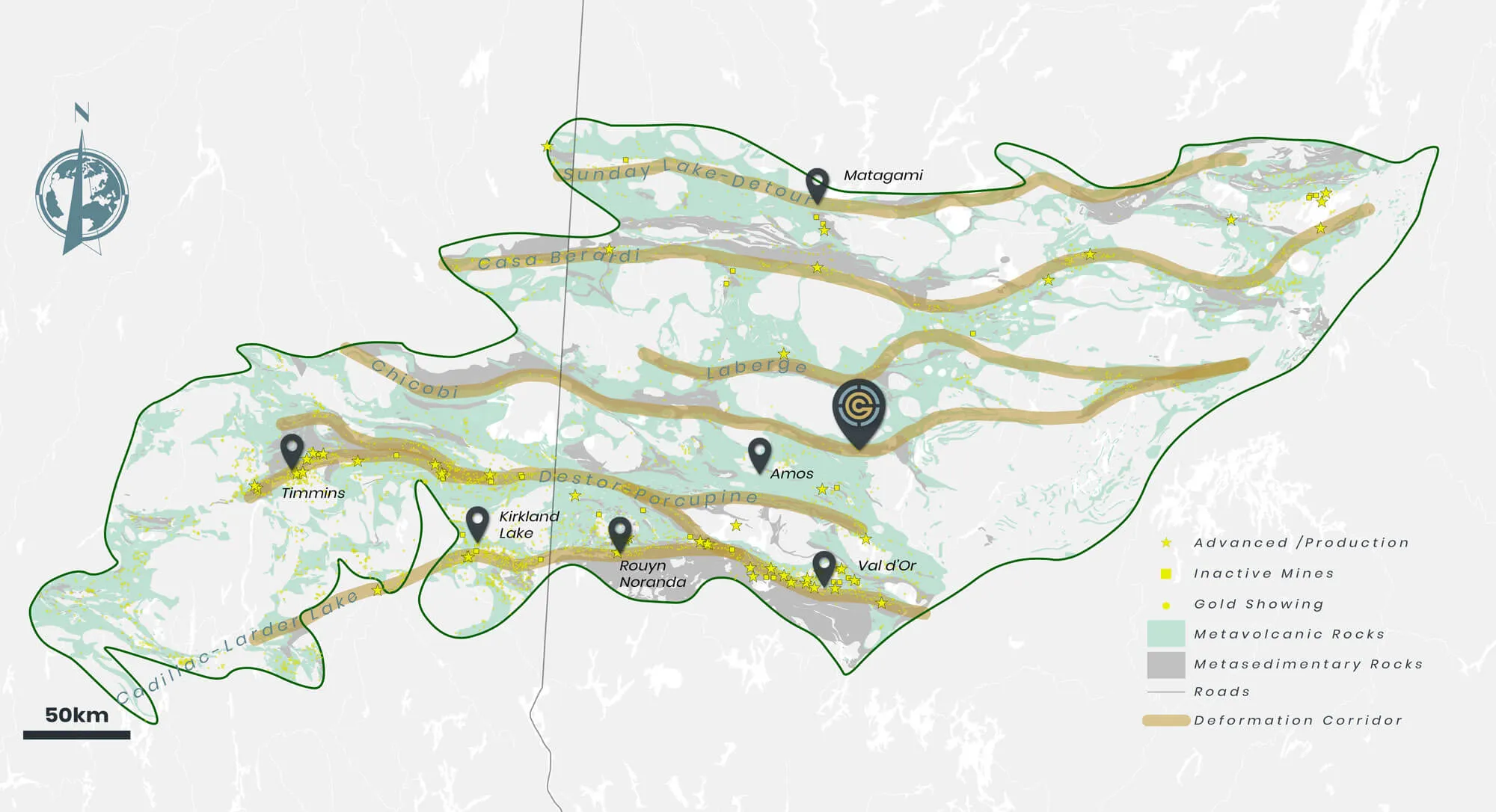

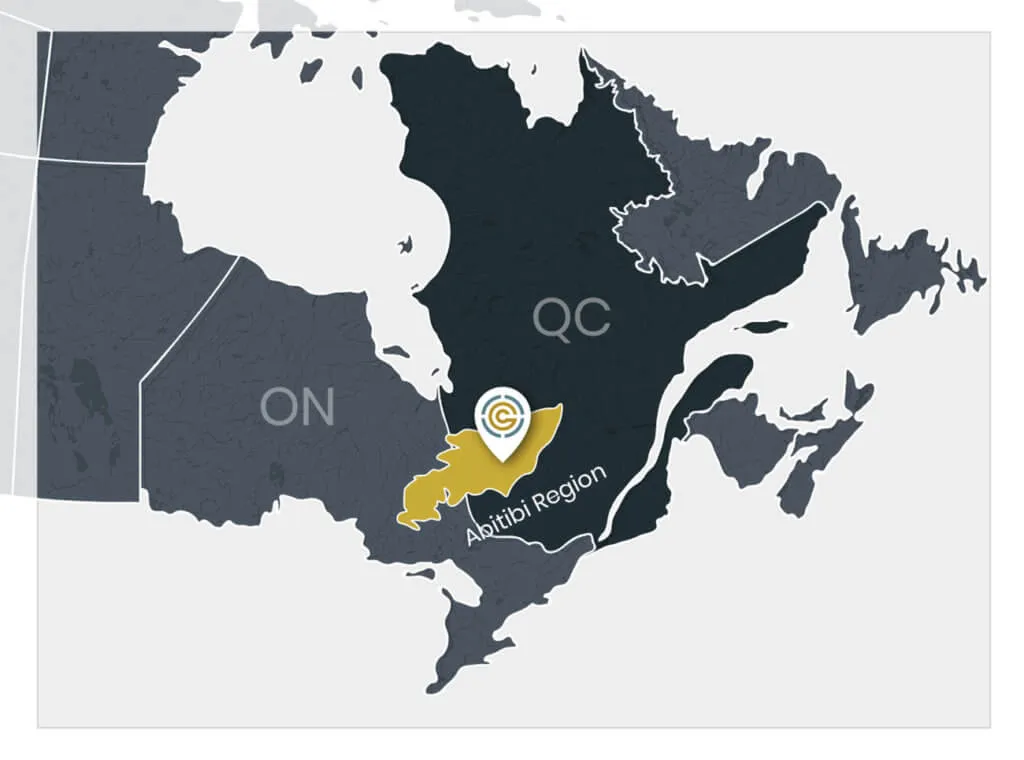

Clarity Gold’s latest acquisition is a 100% option for the Destiny Project, a 5,013 ha area, in the Abitibi Property. This region of Canada extends from Wawa, Ontario to Val-d’Or, in Quebec.

The mineral-rich Abitibi greenstone belt is an established gold mining district with the recognition of having produced over 100 mines, and 170 million ounces of gold since 1901.

Clarity Gold’s Destiny Project is a brownfield exploration area, which means it’s already had extensive exploration completed. Thereby providing Clarity Gold with a clearer vision of what’s there and what can be achieved. Previous drill results show mineralization is present and identified along the 6km strike length of Destiny. Plus, the existing infrastructure is excellent with road access 75km north, north-east of Val d’Or.

The resource has already been diamond drilled 50,000 metres at surface along with some drill holes at depth. These returned strong and encouraging results. Lack of funds and a low gold price probably meant these were never further explored, but now Clarity Gold is excited to acquire full ownership so that it can fully investigate this untapped potential.

Destiny has five known stacked mineral horizons existing within its structural trend. Plus, it already has an indicated resource of 360,000 ounces and Inferred resource of 247,000 ounces. Historical reports show gold mineralization occurring in high-grade quartz veins within shear zones, starting 15m below the surface. And diamond drill results show 167g/t gold (Au) over 1 metre. In 2011, when the Destiny Project was last explored, the companies were prospecting for gold in wide open pits. It wasn’t cost-effective to deep drill, but that’s where it gets really exciting for Clarity Gold.

#A Prime Location for High-Grade Gold Discoveries

75% of Canada’s gold comes from the Abitibi range, making it a prime location for gold exploration. Clarity Gold’s acquisition in the Abitibi Greenstone belt is a strategic move for the relatively new junior.

The historical drilling already undertaken on the property allows Clarity Gold to test for even more gold in its depths. The team’s geologists were very excited to see the stacked mineralized zones present in previous exploration reports. This shows massive potential is present in a significant area renowned for its wealth of high-grade producers.

Here it hopes to get underway with drilling the Destiny Project very soon. And by targeting a deposit similar in structure to the nearby Timmins-camp, which produced 65 million ounces, or the Val d’Or, which produced over 15 million ounces, this promises shareholders an exciting ride ahead.

#A Top-Quality Management Team

Clarity Gold was founded in 2019 and publicly listed in July 2020. Its share price has risen 290% since IPO. Its management team has proven their ability to identify, evaluate and execute transactions on assets. They have identified and completed over 100 resource property transactions and have a tight capital structure in place.

Headed up by CEO James Rogers, and advised by professional geologist Rory Kutluoglu, the pair spent many months looking for the perfect asset to acquire. They stumbled upon Destiny and were drawn in by the extensive research that had already been completed, but abandoned, and of course the prestigious location.

Advisor Rory Kutluoglu has vast international experience. His most impressive achievement to date was drilling out Coffee for Kaminak Gold. This was a 3.5-million-ounce deposit which went on to be sold to Goldcorp Inc., now Newmont Corp. (TSX:NGT | NYSE: NEM) for over $500 million!

The Clarity Gold management team has built the company with the capital markets in mind intent on rewarding shareholders for their help in growing the business.

#Weighing Up the Pros and Cons of Investing in a Junior Gold Company

There are no guarantees when investing in junior gold exploration companies, it’s a risk-reward scenario where things could go in any direction. However, Clarity Gold is named with clarity of vision in mind. And by building on a brownfield project, in a well-known gold producing region, the odds should be stacked in their favour.

It already has an indicated resource of 360,000 ounces and Inferred resource of 247,000 ounces.

It’s situated in a gold producing location sporting multi-million-ounce discoveries in every direction.

Management is invested and aligned with shareholders’ interests.

13.5% of the issued stock is owned by management and a further 15% by investors with close ties to the team.

Clarity Gold has 20,358,000 shares issued and outstanding.

Historical work includes 50,000m of diamond drilling.

Excellent infrastructure in place with road access 75 km NNE of Val d’Or.

Mineralization is present and identified along the 6km strike length.

Drilling has indicated 167 g/t gold (Au) over 1 metre depth.

An experienced team with a proven history of generating money for shareholders.

Investors need to be aware of the risks involved and make a sensible decision based on financial circumstances and the desire to be a part of a potential big gold discovery.

#Will the Price of Gold Rise in 2021?

The price of gold rising is correlated to economic and political uncertainty. With vaccines hopefully eradicating the Covid-19 crisis, this should allow nations a chance to heal. However, economies will take time to return to pre-2020 levels.

The Biden presidency is likely to follow in Trump’s footsteps with regards to international relations. While they should be less fraught with volatility, there could still be animosity across borders. This would be another reason for the gold price to rise. While geopolitical tension is not pleasant, it’s a known trigger to boost the price of gold.

Analysts at Goldman Sachs Group Inc (NYSE: GS) set their gold price target to $2,300 per ounce for 2021. Meanwhile, Citibank (NYSE: C) set its target between $2,200 and $2,400, while an analyst at Capital Economics believes it will be around $1,900.

If 2020 is anything to go by 2021 could be a very exciting year for gold mining shareholders.