Hopes are high that 2021 will confirm the start of a new bull market in uranium.

Many people are predicting that in the near to mid-term the nuclear fuel could see plenty of screens glowing green in the best way possible.

Fans of the heavy metal are quietly confident that the classic combination of reduced supply and increasing demand will be a winning formula for both the element’s spot price and the wider uranium industry.

The high expectations for the uranium market come amid gains in the wider mining and commodities sector with Mining.com proposing that a ‘post-pandemic supercycle in commodities demand’ had contributed to a new record high of $1.3 trillion market capitalisation for the world’s 50 most valuable mining companies.

There are encouraging signs that conditions are ripe for uranium to lead the commodities pack. In a wide ranging YouTube interview, Justin Huhn, founder of Uranium Insider Pro, said, “I’m very bullish on a number of commodities. I think uranium is going to take the cake as far as returns go.”

The optimism comes after an eventful 2020 that saw uranium’s spot price start the year at around US$24.50 before rising 37% and peaking at US$34 in mid-May and then dropping to US$20 at the end of November 2020. By today (13 Jan), it had recovered to just over US$30. Having navigated the choppy waters of last year, industry figures reckon that uranium prices have the potential to sail smoothly upwards.

#Clarity starting to appear

Quoted in Investing News in December, Keith Bodnarchuck, corporate development manager at Canadian uranium explorer and developer IsoEnergy (TSXV: ISO) posited that the unpredictability of 2020 was giving way to more promising prices in the future.

“Uncertainty was the biggest challenge for 2020 in the uranium industry. Uncertainty around COVID-19-related mine shutdowns, signing of the Russian Suppression Agreement, US election and overall volatility of the stock market. As 2020 comes to an end, clarity is starting to appear for some of these uncertainties, which should allow for the underlying fundamentals of a uranium bull market to once again become the focus.”

Supply problems were a major factor in the last uranium bull market. Flooding in 2006 seriously curtailed production at Cameco’s (NYSE: CCJ) Cigar Lake mine in Saskatchewan. Cameco is one of the largest global providers of uranium and Cigar Lake is the world’s top uranium mine. This helped set in chain a bull market that saw uranium’s price explode from around US$36 at the start of the year to US$140 at the start of June 2007.

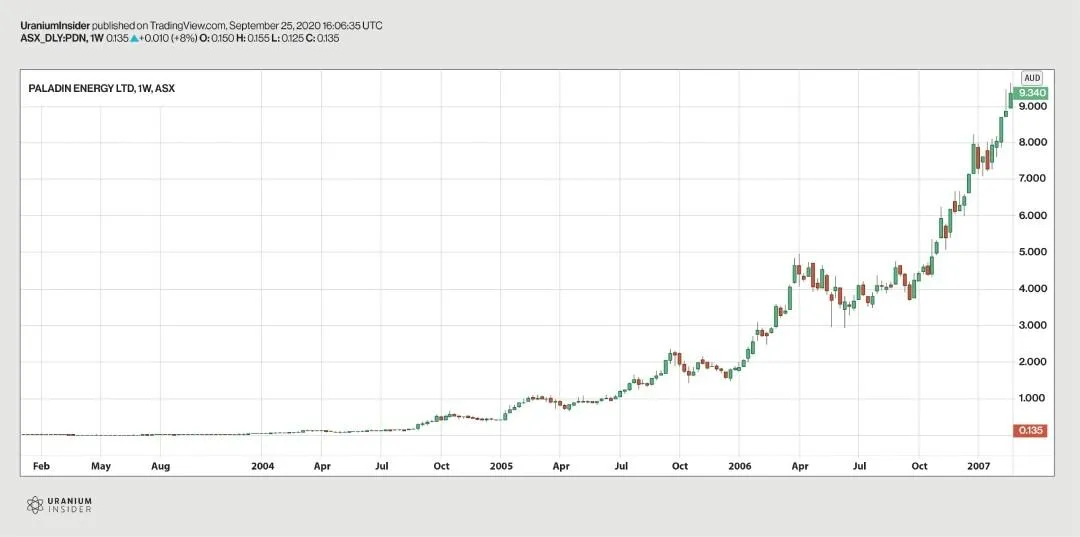

Uranium mining and exploration companies saw exponential equity growth as a result. Uranium Insider Pro illustrates this with a graph showing a 1000x share price increase for uranium miners Paladin Energy. They point out that even large cap Cameco went from under US$4 to US$60, returning over 15x on investment.

The financial crash of 2008 drew a line under the last uranium bull run but supply shortfalls are in the news again and fuelling expectations of price rises.

In the last year, Covid caused considerable disruption to uranium production as several producers shut down operations in order to limit spread of the disease. Cameco’s Cigar Lake went into care and maintenance for six months from March 2020. Not surprisingly, the spot price of uranium started to climb very shortly afterwards.

#Production disruption

Cigar Lake re-opened in September and then in December, after re-opening, announced that it was suspending operations again after further suspected Covid cases. Elsewhere, Kazakhstan’s mining giant Kazatomprom have flexed down operations and put in place suspensions in their ISR uranium mines. They have indicated that they intend to keep flexing down production through 2022. Other significant operations in Namibia and South Africa were also impacted by the pandemic.

Industry commentators such as Philip Johnson of research firm UxC have pointed out that “while many people believe the pandemic is nearing an end, there’s still a long way to go before it’s actually behind us. Thus, the potential for suspensions or disruptions at other major uranium projects is still on the table to some degree. This will definitely be a major issue to monitor in at least the first half of 2021.”

Whether they extend into Q1 and Q2 of 2021 or not, Covid-related complications are adding to more fundamental supply issues for the utilities which use uranium. In a nutshell, after Fukushima in 2011, there was an oversupply of uranium and the price fell. It hit US$18 in November 2017 and, until recently, has bumped along in a narrow range since then.

These low but relatively stable prices have had a number of effects. One of the most significant is that suppliers have cut uranium production saying that it is not viable. They would prefer to leave it in the ground until the price rises above the production cost. Cameco began to curtail production at its McArthur River site in 2017. Then Canada’s most significant and the world’s largest high grade uranium-producing mine, the site’s shutdown was extended indefinitely in 2018.

At the time, Cameco stated:

“We will not produce from our tier-one assets to deliver into an oversupplied spot market. Until we are able to commit our production under long-term contracts that provide an acceptable rate of return for our owners, we do not plan to restart.”

There are different valuations of what an acceptable rate might be but a spot price of US$40 is a realistic minimum.

However, with weakness in the uranium market still continuing after production was cut, utilities have been reluctant to renew or initiate long-term supply contracts with producers. They have been confident that they will be able to continue to buy from the open market at a relatively low spot price. For the same reason, although exact figures are hard to come by, it appears that utilities have also run down their strategic inventories of uranium.

#Higher prices

Essentially, the producers and the utilities have been playing a waiting game. Many in the industry think that the game is changing as the balance between supply and demand becomes tighter. There are a growing number of industry players and analysts who think that the advantage is swinging back in favour of the suppliers and producers. In December, Research company GLJ reported that “Cameco and Kazatomprom, who represent circa 55% of current global uranium production, are managing their output with one objective in mind: higher prices”.

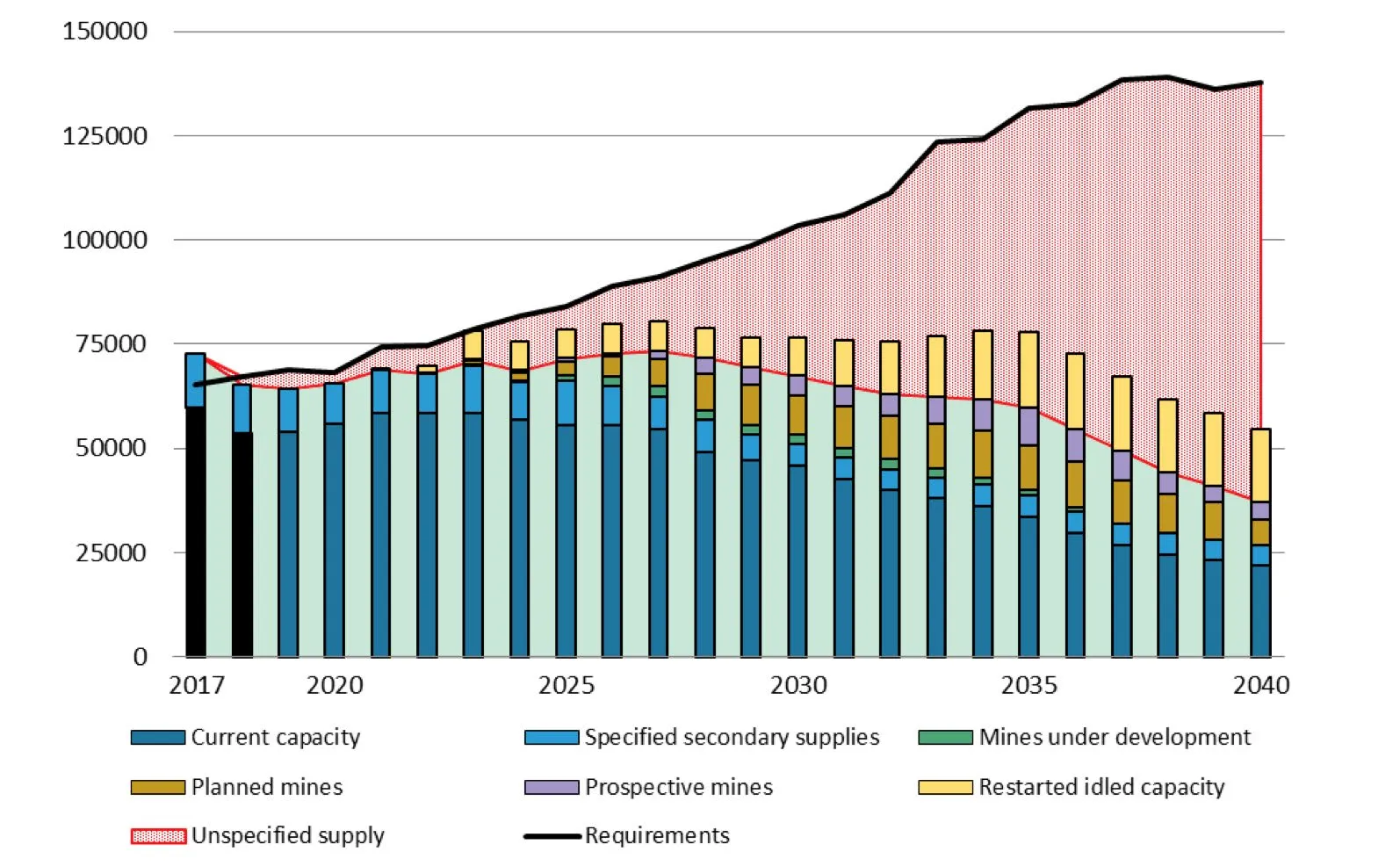

Uranium Insider’s Huhn has run the figures and reckons that each year nuclear reactors uses around 175-180mlb of uranium but annual supply is running at around 150mlb. A report on Zerohedge calculates that total mined supply this year will come in even lower at under 120M lbs, a level not seen since 2008.

Huhn sees the recent situation as a stand-off between producers and utilities:

“Cameco need those (long) term contracts in the 40s to justify bringing McArthur River back online and until they get them they are not going to do it. We are going to continue with a supply deficit until we have these higher prices and the market is just so fragile that anytime we have any disruption like the current Cigar Lake shut down… the price responds immediately.”

Image Taken from IsoEnergy Report – Page 4

#Increased global demand

The current structural shortfall, and consequently higher prices, look likely to be exacerbated by increased demand. At present, there are 440 nuclear reactors in operation around the globe and these supply around 10 per cent of global energy requirements. A further 53 are currently in construction and more than 300 are proposed.

Every new reactor that is in operation or coming into operation needs or will need a regular annual supply of uranium. Happily for anyone in the business of supplying uranium, the new reactors which are coming online will also require an initial load of 2-3 times the annual supply to get operational.

Arguably, there has been a change of sentiment around nuclear energy. With many countries building net zero carbon emission goals into their Covid recovery plans, the clean energy credentials of nuclear look very attractive to governments keen to keep eco-conscious voters onside. The GLJ report already mentioned notes that the greenhouse gas footprint of nuclear also makes uranium stocks look positive to ESG investors.

What is not arguable is that last month, in the United States, the Senate’s Committee on Environment and Public Works approved a bipartisan bill, the American Nuclear Infrastructure Act, designed to establish a U.S. national strategic reserve of uranium. Associated mining stocks rose accordingly.

#US state support

Approval does not mean the law will be passed but the uranium industry is optimistic that the interests of nuclear power will be looked upon encouragingly by the Biden administration.

“The bipartisan Nuclear Infrastructure Act is broad-reaching legislation, important for supporting the U.S. nuclear fuel industry, national security and clean energy,” commented Amir Adnani, CEO and President of Uranium Energy Corporation. “The legislation will provide a clear path for implementation of the U.S. Uranium Reserve and provide a strong platform to revitalize the U.S. Uranium Industry.”

Cameco’s last quarterly update was positive that trade policy, climate change goals and supply risks would lead to utility companies coming to the table to negotiate long-term contracts.

“In an environment where we think trade policy… will create opportunities for commercial suppliers like Cameco and where utilities have growing uncovered requirements, we are excited about the fundamentals for our industry,” CEO Tim Gitzel said. “We see demand for nuclear growing driven by an increasing focus on electrification and the recognition that to achieve this while still meeting clean-air and climate change goals, nuclear will be needed in the toolbox. And this is occurring precisely while there is growing uncertainty and risk around global uranium supply. We believe these fundamentals will lead to security of supply concerns and will allow us to layer in the long-term contracts necessary to support the restart of our McArthur River/Key Lake operations.”

#Best way to ride the bull?

A piece of advice often cited in relation to the uranium market is that “things always move very slowly, until they don’t”. If things are going to start moving quickly, how might the savvy retail investor look to play the potential bull market?

Buying into a key producer such as Cameco could be seen as a relatively safe move. A more exciting option might be to research uranium ETFs which hold a basket of companies in all sectors of the uranium industry. Huhn uses the example of the recent sharp price rise at North Shore Global Uranium Mining ETF (URNM) to illustrate what he sees as institutional funds recognising the potential of uranium:

“When you see funds flowing into ETFS that’s a really good sign. That’s basically institutional money coming into the space… It’s a tiny, tiny industry. I think at this point it is still has a (market cap) of about $15 billion… It’s insanely small so when big money comes in, everything moves and that is what we are seeing right now.”

He adds that funds purchasing physical uranium squeezed the utilities during the last bull market and did a lot of the heavy lifting in pushing the market up.

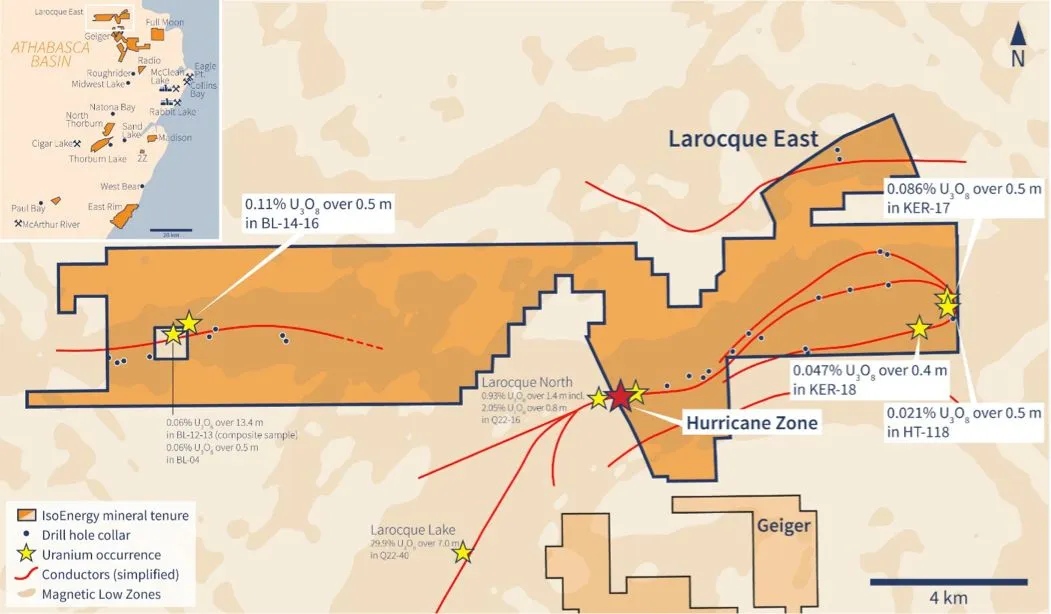

A third way to get involved would be to get in literally at ground level and look at the companies which are exploring for new uranium deposits. IsoEnergy, mentioned earlier, have a good track record exploring for uranium in the eastern Athabasca Basin in Saskatchewan, Canada, an area that hosts the world’s leading source of high-grade uranium. Drilling on the Hurricane zone in their flagship Larocque East property has discovered exceptionally high-grade uranium which has the potential to be a significant deposit.

FOR MORE IN-DEPTH INFO ON URANIUM INVESTMENT AND ISOENERGY, DOWNLOAD OUR FREE EXCLUSIVE REPORT.

Image Taken from IsoEnergy – showing the Larocque East Property Map

Covid may have cast a gloom over global uranium production in 2020 but the resulting shortfalls in supply have set the scene for a potential bull run in 2021. Huhn is certainly saddling up for the ride. His thesis is that even a spot price move of $5 to $10 causes an explosion in the equities but the producers want the current spot price to almost double before they turn the taps back on fully. If that does not happen, he sees substantial supply shortfalls to the point where nuclear power plants cannot operate.

#His conclusion?

“Barring anything catastrophic, it’s basically guaranteed that the uranium price is going to double and anything more than that is the icing on the cake. The way this market functions and fluctuates, it is highly likely that it will overshoot that price.”