The Media and Entertainment industry is an all-encompassing giant comprising the creation, production, and distribution of a range of content. This content includes movies, television, music, digital media, video games, podcasts, AI-generated content and more. The Media and Entertainment industry continues to evolve and plays a key role in reflecting societal changes, shaping culture, swaying public opinion, and delivering entertainment and information to audiences worldwide. This guide aims to give you an overview of all aspects of the industry and how it relates to investing in media and entertainment stocks.

#Understanding the Media & Entertainment Industry

There are many sub-sectors of the industry to consider. From film and television to streaming, book publishing, music, theme parks and gaming. Here’s a rundown:

Key industry segments

Film and television production and distribution

There are many film and television production studios in the world, from household names like Walt Disney Co (NYSE: DIS), Warner Bros Discovery Inc (NASDAQ: WBD), and Universal Corp (NYSE: UVV) to many independent production companies. These studios come up with the ideas, produce them into film and tv shows, distribute them to targeted audiences and assess their success. This assessment will lead to sequels, additional seasons, spin-offs or a clean break.

Broadcast and cable networks

Some of the biggest US broadcast networks include ABC, CBS, NBC, and FOX, while prominent cable networks include CNN, HBO, Paramount Media Networks and ESPN. These networks transmit television programming to viewers. In the case of ABC, it serves popular drama and comedy shows, while ESPN shows sports coverage, such as the UFC, NBA, NFL, and WWE. The broadcast and cable networks generate revenue through advertising and subscription fees. Competition has been intensifying in recent years as streaming services grow their offerings and consumer habits evolve.

Streaming Services

The rise of streaming services from Netflix (NASDAQ: NFLX), Amazon (NASDAQ: AMZN), Disney (NYSE: DIS) and Comcast (NASDAQ: CMCSA) in recent years has been astounding, and they’re not alone. Netflix, Disney+, Amazon Prime, Hulu, HBO Max, Discovery+, Apple TV+, ESPN+, Paramount+ and even YouTube Premium are rapidly changing the landscape and creating tough competition as viewers suffer from choice paralysis and limited budgets.

By offering on-demand access to movies and television shows with little-to-no interruptions, these streaming platforms have attracted millions of subscribers that now challenge traditional distribution channels. As a result, they have become major players in the production and distribution of original content, further shaping the industry landscape.

Publishing (Books, Magazines, Newspapers)

The publishing segment includes traditional books, magazines, and newspapers, along with e-books, audiobooks, podcasts, and interactive or immersive content online, such as digital magazines. The publishing segment of the Media and Entertainment industry has not evolved as quickly as the streaming segment, but consumers are beginning to subscribe to digital offerings and consume their published content in new ways.

Music Production and Distribution: The music industry involves the creation, production, and distribution of music by artists, record labels, and publishers. The rise of digital platforms like Spotify, Apple Music, and YouTube has significantly altered the way people consume music, shifting revenue streams and distribution channels. Live performances and merchandise sales have become increasingly important for artists to generate income.

Live Events (Concerts, Festivals, Theater)

The COVID-19 pandemic significantly impacted live events, forcing the industry to adapt to include virtual and hybrid formats to keep audiences engaged. Since reopening, demand for live events, such as concerts, music festivals, and theatre performances, has soared. The revenue generated from live events comes from ticket sales, sponsorships, and merchandise sales.

Theme Parks and Attractions

The theme park segment was also hard hit by COVID-19. Consumers enjoy immersive entertainment experiences at real-world attractions such as roller coasters, themed areas of the park, and live shows. Disney is undoubtedly the world’s best-known theme park operator, but Universal Parks and Resorts, Merlin Entertainments, and Six Flags are also big players in the space. In recent years, the industry has been leveraging technology, such as virtual reality and augmented reality, to enhance visitor experiences and drive growth.

Gaming and eSports

Gaming has experienced tremendous growth in recent years, driven by advancements in technology and the emergence of new business models like free-to-play and subscription services. eSports, the competitive aspect of gaming, has also increased in popularity, attracting significant investment, influencers, and sponsorship deals. Now artificial intelligence (AI) is further accelerating changes in this space. In gaming, AI is helping create more responsive, adaptive, and challenging games, ultimately providing an improved experience for gamers.

#Why Invest in the Media and Entertainment Industry?

There are many reasons you might like to invest in the Media and Entertainment (M&E) industry, including growth potential, portfolio diversification, resilience, and simply because, on the face of it, it’s easy to understand.

Growth potential

With its rapidly changing nature, the Media and Entertainment industry has significant growth potential. As technology continues to evolve and consumer preferences shift, new opportunities for revenue generation and market expansion are emerging.

Portfolio diversification

Media and Entertainment include various subsectors giving investors a wide selection of related stocks to invest in. This means the industry can provide portfolio diversification to reduce investment risk.

Resilience

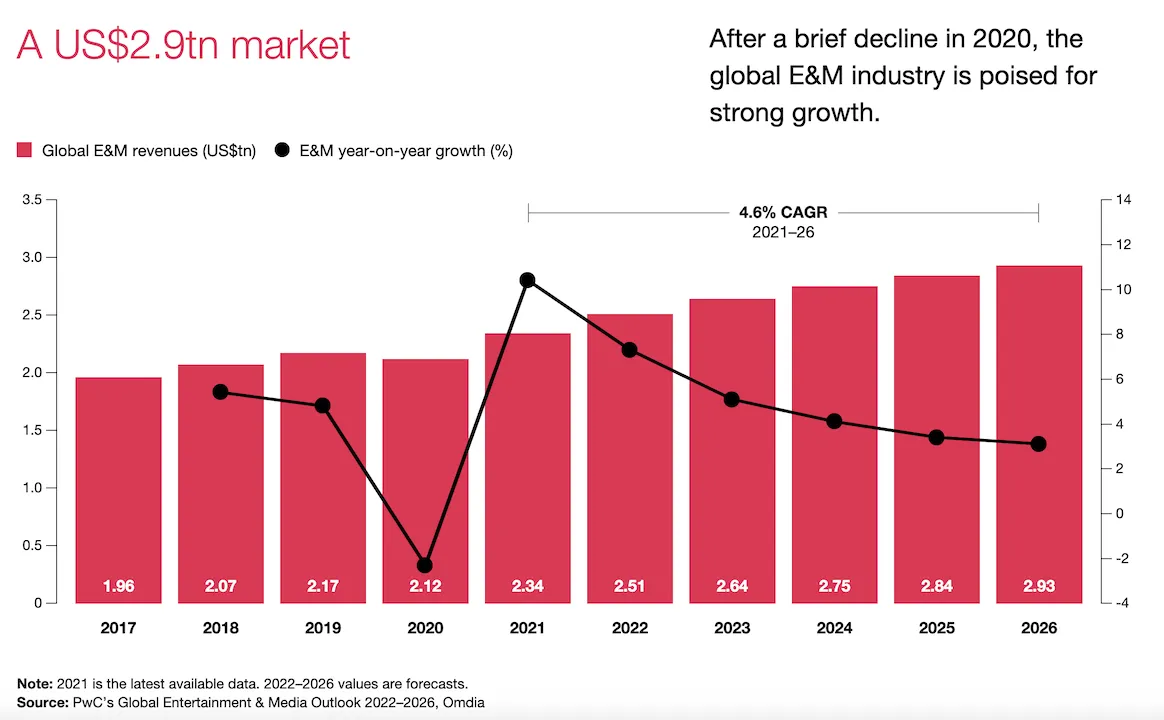

The Media and Entertainment industry has historically shown resilience during economic downturns, as people tend to consume more media and entertainment when faced with uncertainty or difficult times. According to PwC, the global entertainment and media industry is poised for strong growth.

Furthermore, according to Deloitte, in 2023, streaming video, social media, and gaming are driving innovation and transforming the media and entertainment landscape. These sectors are becoming increasingly interdependent, creating a more integrated and diverse ecosystem. Companies that excel are expected to develop comprehensive strategies encompassing these sectors, ultimately propelling the entire industry forward.

Biggest Players in the Sector

Some of the biggest players in the industry include:

Walt Disney Company (NYSE: DIS) (Disney+, ESPN+, Hulu)

Netflix (NASDAQ: NFLX)

Comcast Corporation (NASDAQ: CMCSA) (owner of NBCUniversal)

Amazon (NASDAQ: AMZN) (Amazon Prime Video)

Apple (NASDAQ: AAPL) (Apple TV+)

Alphabet (NASDAQ: GOOGL) (YouTube Premium)

Warner Bros Discovery Inc (NASDAQ: WBD) (Discovery+, HBO Max)

Paramount Global (NASDAQ: PARA) (Paramount+)

Less Well-Known Subsector Players

In addition to the major players, there are many companies operating within the industry's supply chain, here is a small snapshot of them:

Content production companies (Lions Gate Entertainment Corp (NYSE: LGF.A))

Visual effects and animation studios (e.g., Industrial Light & Magic, Pixar)

Technology and infrastructure providers (Roku (NASDAQ: ROKU), Akamai Technologies, Inc (NASDAQ: AKAM))

Gaming companies (Activision Blizzard (NASDAQ: ATVI), Electronic Arts (NASDAQ: EA))

Radio Broadcasting (Fox Corp (NASDAQ: FOXA), Urban One Inc (NASDAQ: UONE))

Networks (AMC Networks (NASDAQ: AMCX))

Venues (Madison Square Garden Entertainment Corp (NYSE: MSGE))

Telecommunications providers underpin the industry infrastructure (AT&T Inc (NYSE: T), T-Mobile Us Inc (NASDAQ: TMUS), Verizon Communications Inc (NYSE: VZ))

Geographic Concentration

While the M&E industry has a global presence, there is a notable concentration of businesses in certain regions, such as:

California, USA: Hollywood is the heart of the film and television industry, with numerous studios, production companies, and related businesses based in the area.

New York, USA: New York is home to many media conglomerates, television networks, and advertising agencies.

London, UK: London serves as a hub for European media and entertainment, hosting several broadcasters, production companies, and creative agencies.

#How to Invest in Entertainment Stocks

There are several ways to invest in the M&E industry, including:

Individual Stocks: Investors can buy shares of individual companies operating within the M&E industry, such as those mentioned above.

Exchange-Traded Funds (ETFs): ETFs offer diversified exposure to the M&E industry by investing in a basket of stocks. Examples of M&E-focused ETFs include the Invesco Dynamic Media ETF (PBS) and the VanEck Vectors Gaming ETF (BJK).

Mutual Funds: Some mutual funds focus on the M&E industry or allocate a significant portion of their portfolio to M&E companies. Examples include the Gabelli Multimedia Trust (GGT) and the T. Rowe Price Communications & Technology Fund (PRMTX).

Direct Investment: Investors can also invest directly in M&E projects, such as film productions or gaming companies, through crowdfunding platforms or private equity deals.

Before investing in the M&E industry, it is essential to conduct thorough research and consider factors such as company performance, competitive landscape, and industry trends to make informed decisions.

#Unique Characteristics of the Industry

Creativity and talent-driven: The success of a project largely depends on the creativity that’s gone into it, which comes from the talent with the ideas and work ethic. These contributors include artists, illustrators, writers, performers, photographers, and technicians supporting the project's conception. Consequently, the industry thrives on fostering and nurturing talent, as well as investing in their development to ensure the businesses involved remain competitive and successful.

Intellectual property rights: IP rights are fundamental to the Media and Entertainment industry because they provide legal protection for original creative works. Along with protection, it incentivizes creativity because it ensures the talent is fairly compensated for their work, and it can help a business expand its offering by building a library of unique, valued content. IP rights include copyrights, patents, trademarks, and trade secrets, which together form a complex legal framework that governs the industry. You can read more about this in The Value of Understanding IP For an Investor.

Hit-driven business: The highly competitive nature of the Media and Entertainment Industry has created a hit-driven business. This means that a small number of successful projects can generate a significant portion of the industry's revenues - think Marvel, Star Wars, and Harry Potter. This can create a high-risk environment for investors, as predicting which projects will become hits is challenging. As a result, companies are increasingly turning to data analytics, market research, machine learning and AI to identify trends and gauge audience preferences.

Digital disruption and technology: Digitization has revolutionized content distribution, giving rise to new platforms and business models like streaming services while transforming the way content is produced and consumed. The rapid pace of technological advancements continues to reform the landscape, with virtual reality, AI, and even blockchain likely to cause further disruption.

Global reach and cultural impact: Globalization and the tech revolution have made the spread of information faster and easier. Human nature loves to learn about cultural change, societal differences, and the minute details of our lives. This gives huge scope to the media and entertainment industries to generate stories based on multicultural origins. Thus, the industry also plays a crucial role in shaping culture and influencing societal values, making it a powerful force in the modern world.

Regulatory environment and censorship: Given the industry's significant cultural and economic influence, it is subject to various regulatory frameworks and censorship laws across different countries. These regulations may relate to content restrictions, privacy laws, or anti-piracy measures, among others. Navigating the complex regulatory landscape is a necessary aspect of the Media and Entertainment industry, as companies must adapt their strategies to comply with diverse legal requirements while safeguarding their creative freedom and protecting their brand image.

#Industry Analysis: Assessing the Landscape

Market trends and growth drivers: Some of the market trends and growth drivers of the Media and Entertainment industry include the explosion of streaming services, personalization and AI-driven recommendations, demand for original content, eSports and gaming. Then there are also the bigger issues, such as globalization, demographic shifts, environmental concerns, and technological innovation.

Competitive landscape: Competition is fierce in the Media and Entertainment industry, with companies vying for market share and consumer attention. Key factors for investors to consider when analyzing a stock’s competition include its market share, barriers to entry or expansion, competitive rivalry, and the threat of substitutes, which means consumers can easily switch to alternative products or services that satisfy their needs.

Market challenges and risks: Businesses in Media and Entertainment face multiple market challenges and risks in their bid to maintain a competitive edge. These include regulatory changes, economic conditions, supply chain disruptions, fast-changing consumer preferences, and shorter attention spans.

Mergers, acquisitions, and consolidation: As the industry is so competitive, it is prone to M&A. Many of the big players have used this strategy to grow their market share and expand their product offerings, including Disney and Universal. Consolidation can quickly remodel the industry landscape by creating new market leaders, altering the competitive dynamics, and driving innovation.

The role of technology and digital transformation: Digital transformation has thoroughly transformed the entertainment industry and continues to shape its evolution. Data-driven decision-making, automation and AI, digital customer engagement, and cybersecurity are all issues investors should consider when analyzing a stock in the Media and Entertainment industry.

#Financial Analysis: Evaluating Company Performance

Key financial metrics and ratios for Media & Entertainment companies: To start evaluating an M&E stock, some of the key metrics and ratios to consider include revenue growth, gross margin, EBITDA margin, return on equity (ROE) and debt-to-equity, in addition to the market cap, earnings per share (EPS), price-to-earnings (P/E) ratio, and operating margin.

Revenue models and monetization strategies: Media and entertainment companies make money through varying means, including subscriptions, advertising, pay-per-view and licensing or syndication.

Understanding content costs and profitability: Demand for original content is high, so it’s important to assess the costs of producing this or buying from third parties. Content amortization is when a company spreads its content costs over a specific period, which can impact its financial statements. You can also look at the company’s profitability by content type (movies, TV shows, live events) to see which is most profitable to the business.

Assessing the balance sheet: A thorough balance sheet analysis should include a close look at the company’s ability to manage debt, its cash flow activity, and its capital expenditures, which could impact growth and profitability.

Importance of intellectual property valuation: Original content and franchises have significant value and investors can take a closer look at this by looking for copyrights, trademarks, and patents. Does the company generate revenue through its IP from licensing? is its IP protected? Will the IP protection expire? Unique or distinctive IP can bring a competitive advantage which can boost its potential for long-term success.

Check out our investing insights and signals for further M&E stock ideas.

#Building a Diversified Media & Entertainment Portfolio

Diversification is part of an investor’s risk management strategy. Volatility and unpredictability are to be expected in the media and entertainment industry as its largely dependent on consumer disposable income. Therefore, geopolitical events, macroeconomic changes, and technological advancements can affect its success. Investors should monitor market trends and economic indicators regularly to stay informed, identify opportunities and adapt investment strategies accordingly.

Large-cap vs. small-cap stocks: Big companies like Disney and Netflix have a strong track record making them relatively lower risk than smaller companies in the early stages of growth. Investing in a mix of these can help to balance a portfolio.

Growth vs. value stocks: Growth stocks are expected to grow their earnings faster than the industry average. These are attractive but come with higher risk. Value stocks are those believed to be undervalued, this may be due to market sentiment, internal disruption, or other external factors. Owning a mixture of growth and value stocks can help diversify your portfolio.

Dividend-yielding stocks: Companies that regularly pay dividends are seen to be shareholder friendly. Investors like this as it brings a regular income stream that can offset the effects of market volatility. Including dividend stocks in your portfolio can bring an additional source of income and a degree of stability during a market downturn.

Geographic diversification: Investors can further diversify their portfolios by investing in companies based domestically and abroad. This can also mitigate risks associated with regional economic downturns or regulatory changes in the media and entertainment industry.

Thematic investing: Thematic investing involves focusing on specific trends or sectors with high growth potential. In media and entertainment, themes include streaming (Netflix, Disney+), gaming (Electronic Arts, Activision Blizzard), and virtual reality (Meta Platforms, Unity Technologies). By concentrating on these high-growth areas, investors can capitalize on emerging trends and technologies within the media and entertainment sector.

#Contrarian Views and Alternative Perspectives

The Media & Entertainment industry has long been considered a profitable and promising sector for investors, but it is not immune to potential pitfalls and weaknesses. Red flags investors should watch out for include market saturation and changing consumer preferences.

Market saturation could lead to lower margins, higher customer acquisition costs, and increased competition for talent and resources. Meanwhile, consumer attention shift from traditional consumption patterns to on-demand streaming continues to shake up the industry.

Furthermore, user-generated content and social media platforms are appropriating market share and allowing users to share and consume content at an unprecedented pace. This has led influencers and content creators to leverage their audiences to monetize through advertising, sponsored content, and direct-to-consumer offerings.

Investors can identify underappreciated opportunities by monitoring these changes. Potential investment areas include companies specializing in niche content that could capture loyal and dedicated audiences, emerging markets, and companies that provide underlying infrastructure, technology, and services to enable content creation and distribution.

#Final Thoughts

When it comes to investing in the media and entertainment industry, it's essential to remember that it's a dynamic and exciting space, constantly evolving with new technologies and changing consumer preferences. It's an industry that has proven to be resilient, despite facing numerous challenges such as piracy, changing distribution channels, and intense competition.

However, it's also crucial to keep in mind that investing in this sector can be volatile and unpredictable. The success of a media company can depend heavily on the reception of its products by consumers, which can fluctuate over time. As a result, investing in this industry requires careful evaluation of both the company's financials and the industry's growth potential.

You should be aware of the following essential factors that should be considered when investing in media and entertainment.

Understand the Industry: As mentioned earlier, it's crucial to have a deep understanding of the media and entertainment industry before investing. This includes keeping up with the latest trends, technological advancements, and changes in consumer behavior that can impact the sector's performance. Our Analyst Brief on Investing in Media & Entertainment Stocks provides a deep analysis of the sector which is a must-read before you invest in this industry.

Evaluate the Company's Financials: Once you've identified a potential investment, evaluate the company's financials to determine its financial stability and profitability. Look at key financial metrics such as revenue growth, profit margins, and cash flow to assess the company's financial health.

Assess the Company's Competitive Position: In addition to evaluating financials, it's also essential to assess the company's competitive position in the industry. Look at factors such as brand strength, product differentiation, and distribution channels to determine whether the company is a market leader or struggling to keep up with the competition.

Look at Industry Growth Potential: Finally, assess the industry's growth potential over the long term. Consider factors such as population growth, technological advancements, and cultural changes that can impact the industry's growth potential.

As a final takeaway, it's important to remember that investing in media and entertainment requires a diversified portfolio to manage risks and maximize returns over the long term. It's also essential to remain patient and vigilant, regularly monitoring both the company's performance and industry trends to make informed investment decisions. By doing so, you can potentially benefit from the sector's exciting opportunities while minimizing the inherent risks.