Jaguar Land Rover (JLR) is rumored to be getting ready to publicly list on the financial markets. However, its parent company Tata Motors (NSE: TATAMOTORS) (BOM: 500570) is already publicly listed in India. So, the question is, does it make more sense for investors to buy shares in Tata Motors or Jaguar Land Rover at IPO?

Source: media.jaguarlandrover.com/en-gb/images

#Who Owns Jaguar Land Rover?

Tata Motors Limited, headquartered in Mumbai, India, operates as an Indian multinational automotive manufacturing company. It forms an integral part of the Tata Group. Jaguar Land Rover (JLR), a UK-based luxury carmaker and a subsidiary of Tata Group, there's no entity specifically called "Tata Land Rover."

#Is a Jaguar Land Rover IPO Imminent?

Rumors of a Jaguar Land Rover IPO have been circulating for some time. But rising consumer sentiment may propel the company to launch publicly sooner rather than later. Particularly if investor appetite appears to be strong.

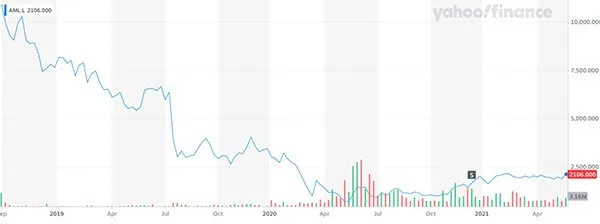

However, the allure of investing in luxury automakers is heightened by the desire to own a piece of the brand. This could create extreme volatility in the stock, as has been the case with Aston Martin Lagonda (LON: AML). AML launched on the London Stock Exchange in October 2018 with great excitement, being that it was the first UK carmaker to list in London since the 1980s.

Aston Martin Lagonda share price slides since IPO – Source: Yahoo Finance

But its share price is now down over 90% since its IPO. This could very well scare potential investors, particularly institutional investors, from touching Jaguar Land Rover. But if the IPO is priced reasonably, then it may still be attractive.

To avoid unnecessary risk, shareholders may prefer to opt for an investment in Tata Motors as it should still provide exposure to a stake in Jaguar Land Rover. It will also provide access to emerging markets for those investors looking to diversify. Plus, being a $15 billion company, it’s a highly liquid stock. This also makes it attractive to fund managers and global institutions.

Whether opting to invest in JLR versus Tata, really comes down to personal preference, risk appetite, and a desire for diversification. Of course, when and if JLR decides to IPO remains to be seen.

#Tata Motors Fluctuating Share Price

Disappointingly, the Tata Motors share price entered a prolonged downward trajectory between 2016 and 2020. Enduring a particularly spectacular plunge in February 2019. This was its biggest share price fall in 26 years, after having to declare a £3.1 billion write-down of its investment in Jaguar Land Rover. But since the Covid-19 March 2020 market crash, the TATAMOTORS share price has rallied.

Tata Motors share price – Source: Yahoo Finance

#2021 Sees Jaguar Land Rover Fortunes Turn

Q4 2021 profits were mainly thanks to its Jaguar Land Rover division. By mid-May the JLR order book was sitting at 100,000 units, growing at around 2,000 vehicle orders a month.

Source: media.jaguarlandrover.com/en-gb/images

JLR’s net revenue rose 106% in Q4 and 7.1% for FY21.

During this period Jaguar Land Rover booked a pre-tax profit of £534 million after sales rose 12%. This was mainly seen in China and the United States. The company sold nearly double its prior year's vehicle count in China and enjoyed a 10% uplift in North America.

Considering COVID-19 is running rampant through India, revenues from elsewhere are greatly welcomed.

Moreover, an improvement from Jaguar Land Rover is long overdue as Brexit, the diesel emissions backlash and Covid-19 have presented compounding challenges in recent years. And now the global chip shortage poses a further problem as it affects manufacturing. There are also mounting concerns that the chip shortages will continue for several years.

In addition, Tata Motors is also facing rising commodity prices which cut into its profit-making potential.

In Tata’s recent earnings call a company representative said:

“While demand remains strong, the supply situation over the next few months is likely to be adversely impacted by disruptions from Covid-19 lockdowns in India and semiconductor shortages worldwide,”

JLR is going for gold in electrification, having launched its Reimagine strategy. Through this, Jaguar Land Rover strives to become a global leader in luxury EVs. It doesn’t see Tesla (NASDAQ: TSLA) as a threat because Tesla started with luxury and is now moving into more affordable basic ranges.

Nevertheless, the EV space is hugely competitive and overcrowded. If it can pull off its ambitions, it stands to be lucrative for shareholders, but there’s significant risk in this area.

In 2021, the overall loss Tata Motors was dealing with could be blamed on a mix of asset write-downs and restructuring costs. Without this, the operational performance showed pretty good revenue growth.

#September 2023 Update

Jaguar Land Rover (JLR) reports a robust financial performance for the fourth quarter of the fiscal year 2023 (Q4 FY23) and the full fiscal year ending March 31, 2023 (FY23). In Q4, JLR saw its revenue soar to £7.1 billion, marking a 49% Y/Y increase. The company also witnessed a 24% uptick in wholesale units, reaching 94,649 for the quarter.

JLR free cash flow stood at £815 million, contributing to a full-year figure of £521 million.

The company also managed to reduce its net debt to £3 billion, with a liquidity pool of £5.3 billion.

JLR continues its "Reimagine Transformation," investing £15 billion over five years in electrification and digital transformation. The company has reskilled over 11,300 employees for electrification and opened three global tech hubs. It also announced new partnerships and strategies, including a collaboration with Tata Technologies and the unveiling of new electric vehicle models.

For fiscal year 2024, JLR aims to further increase its EBIT margins to over 6% and significantly reduce its net debt, while ramping up investment to £3 billion. The company remains optimistic despite ongoing supply chain challenges, expecting a continuous improvement in chip supply.