Airbnb property Airbnb (NASDAQ:ABNB) is releasing its Q1 results on Thursday. Shareholders have high hopes for the long-term company outlook, but in the interim, can it hold investors’ interest? This will be its second earnings call since publicly listing via initial public offering (IPO) in December.

Source: news.airbnb.com – Airbnb Luxe – Wanaka

#Tech stock selloff

Global tech stocks are experiencing a sustained selloff and Airbnb’s share price has been crucified this week. So, better than expected results may help it rally off the lows, but a poor performance could cause the stock to plummet.

Analysts are expecting around $717.8 million in revenue a loss of $1.14 per share. In its last earnings call the company forecast a year-over-year decline for Q1 would be narrower than Q4, so investors are hopeful it’s pulled that off.

But the global reopening is slower than anticipated and with Covid-19 still rampaging through India, Japan and Brazil, it may be a while before bookings really take off.

Investors will be paying close attention to booking figures in both nights and experiences booked. The gross booking value will also be of particular interest. Wall Street is expecting around $7.5 billion in gross bookings.

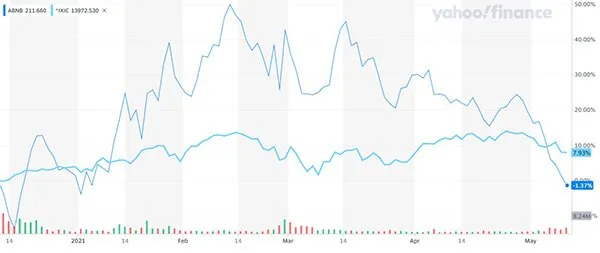

While the Airbnb share price appeared to be outperforming the NASDAQ in the interim, since IPO the NASDAQ has done better.

Source: Yahoo Finance Airbnb share price chart vs NASDAQ

#Playing the long game

The Airbnb share price is now 1.3% below its IPO price and 35% down on its 52-week high. That’s a bitter pill to swallow for those investors buying in at the highs. Therefore, Airbnb is definitely a stock to play the long game, rather than try to make a quick trade.

Urban is a really important part of Airbnb’s business, over 40% of its nights are urban bookings. But during the pandemic it’s been seeing greater growth in non-urban and low-density urban occupation. In its February earnings call the company executives discussed how as the US reopens, the urban hotels may take longer to come back online. Meanwhile, bookings are more likely to come in for smaller and rural communities as people look to escape the city confines.

For the stock to massively outperform long term, we need Covid-19 to subside and bookings to explode. That’s going to take some time on a global scale, but as the the US vaccine rollout is going well, growth domestically could start to accelerate in the coming months.

Source: news.airbnb.com – Airbnb – New York

If Airbnb can continue to monetize other aspects of its business, it could grow its revenue streams and increase its investment profile. For instance, creating collaborative deals with business partners, such as air travel, car rentals, eating out, local attractions, entertainment etc. This would mean it could offer enhanced package deals at a discount.

It’s already begun diversifying its offerings into work-from-home possibilities and both on and offline experiences.

The total addressable market for Airbnb could be over $3.4 trillion if it plays its cards right. But competition is hotting up and there are many hurdles to get over first.

#A game changing business with potential

Airbnb is undoubtedly following a game changing business model. The company enjoyed phenomenal success prior to the pandemic hitting. Many hosts have become reliant on the additional income, while guests can’t wait for the opportunity to travel again.

But there are certainly more concerns than before. It’s going to cost hosts more to ensure their rentals are up to a superior hygiene standard and guests may have to pay more to meet these additional expenses. Plus, with the prospect of inflation raising its ugly head, this poses another potential problem.

Thanks to the recent share price drop, the risk-reward ratio has become more attractive. However, it takes shareholders with a strong conviction in the future of the company to take the plunge and invest while the tech stock rout continues.