Disseminated on behalf of Medicus Pharma ValueTheMarkets, a trading name of Digitonic Ltd., was compensated by Medicus Pharma one hundred and seventy five thousand US dollars starting 3rd March 2025 for a period of 4 weeks until 28th March 2025 to produce and disseminate this. Digitonic Ltd. does not own a position in Medicus Pharma

INVESTING OPPORTUNITY

Biotech Growth Stock Disrupting Skin Cancer Treatments

Healthcare

Medicus Pharma | Listed on: Nasdaq: MDCX

About Medicus Pharma

Medicus Pharma Ltd. (NASDAQ: MDCX) is a biotech and life sciences company focused on advancing novel therapeutic assets through clinical development and commercialization. Its wholly owned subsidiary, SkinJect, is developing a dissolvable microneedle patch to treat basal cell carcinoma (BCC), the most common skin cancer worldwide. With clinical patents secured through 2035 and a Phase 2 trial underway, Medicus aims to expand its pipeline through acquisitions and partnerships.

Why This Opportunity Stands Out

First-in-class microneedle patch technology: Non-invasive, painless, and cost-effective alternative to Mohs surgery, the current standard of care.

Breakthrough treatment option: 5 million+ basal cell carcinoma (BCC) cases diagnosed annually in the U.S.

Large market opportunity: Targeting a $15 Billion+ annual market for BCC treatment.

Phase 2 trial progress: Over 50% of patients enrolled; interim data expected in Q1 2025.

Regulatory pathway advantage: Potential FDA Fast-Track designation.

Strong financial position: No long-term debt, $16M raised in 2024, sufficient cash for Phase 2 completion.

Analyst confidence: Share price targets of $10 (Maxim Group) and $12 (Brookline Capital)4 - more than 240% to 300% upside based on a $2.90 closing price on 4 March 2025.

(Note: Analyst targets are based on projections and assumptions that may not materialize).

IP Protection: University-developed technology with patents secured through 2035.

Reasons to Invest

First-in-Class, Patent-Protected Innovation

Medicus Pharma is developing a novel, targeted therapy for basal cell carcinoma (BCC) - the most common cancer worldwide. With strong patent protection, it offers a groundbreaking and cheaper alternative to surgery. The SkinJect patch can be applied during three weekly 30 minute office visits over 2 weeks. It is non-invasive, relatively painless, cost-effective, and aesthetically pleasing.

De-Risked Asset with Strong Clinical Progress

SkinJect delivers precisely controlled measures, ensuring effective treatment with minimal exposure. It has undergone pre-clinical, safety and tolerability studies. Phase 2 interim trial data is expected in Q1 2025, and the potential for a Type C FDA meeting in Q2 could qualify it for an expedited regulatory review process as a novel, non-invasive BCC therapy, subject to FDA requirements.

Industry Veterans with Big Pharma Backgrounds

Medicus Pharma’s management and board include industry veterans from Pfizer, Novartis, and GSK, with proven success in pharmaceutical research, regulatory approvals, and commercialization.

Strong Financial Position & Shareholder Alignment

Medicus Pharma has sufficient cash to fund operations through its Phase 2 trial. It has no long-term debt and minimal warrant overhang, ensuring financial flexibility. Its simple share structure, with no preferred shares or special deals, treats all shareholders equally. The CEO has invested nearly $4M, with the leadership team contributing over $1.5M.

Large Market Opportunity

The SkinJect patch addresses an unmet medical need with a significantly larger total addressable market (TAM) than many blockbuster cancer treatments. It also anticipates far lower development costs, with anticipated costs in the region of $75M to $100M, substantially lower than top-selling cancer therapies, which can cost billions of dollars to produce. With 5 million new cases of basal cell carcinoma each year, its market far exceeds the 300,000 to 500,000 TAM for leading pharmaceuticals targeting breast, prostate, lung, and hematologic cancers. This high demand creates room for multiple treatment options, positioning SkinJect as a strong competitor in the space.

Growing Market Opportunity in Basal Cell Carcinoma

Basal cell carcinoma accounts for nearly five million new cases annually in the U.S., and this number is growing. A non-surgical treatment for basal cell carcinoma is projected to address a $7B+ market opportunity with high unmet medical need.

Clinical Unmet Needs

BCC incidence demonstrates concerning growth trajectories that SkinJect could address:

Rising Cases in the U.S.: Around 5 million annual cases2. BCC incidence rising by 4–8% each year7.

Increasing incidence in the elderly: 40-50% of Americans who live to age 65 will experience BCC or SCC at least once2.

Access Gaps: 80.4% of U.S. counties lack Mohs surgeons8.

Mohs Surgery Waiting Times: The typical waiting time for Mohs surgery, from initial consultation to surgery, is 215 days. During this time, the BCC lesion(s) can grow an average of 3mm (1.41x increase)9.

Immune Priming: SkinJect's localized compound delivery induces the patient’s immune response to prevent recurrence at the site of treatment2.

Sector Opportunity

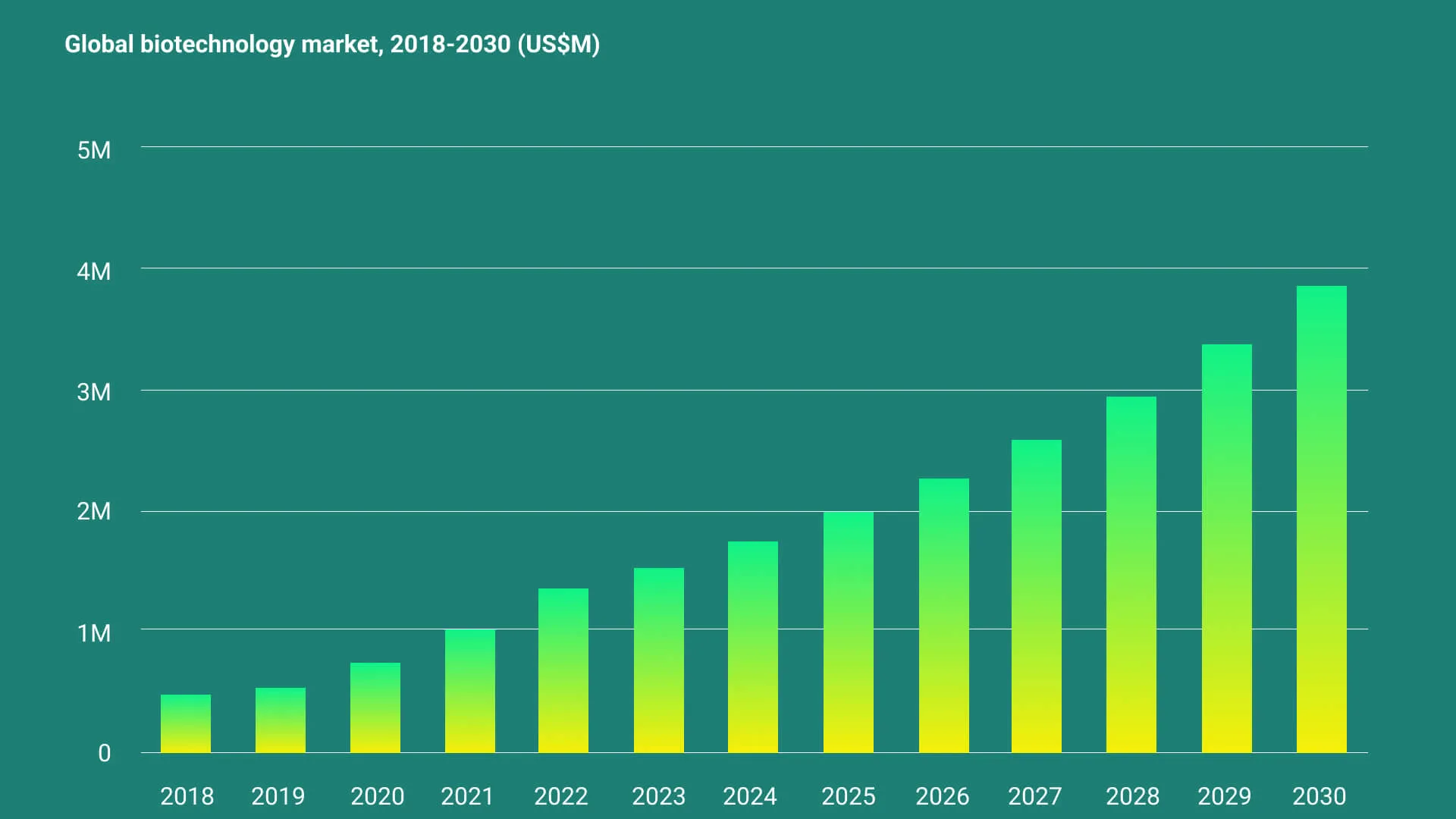

Medicus Pharma (NASDAQ: MDCX) is positioned within a rapidly expanding global biotech industry valued at over $1.5 trillion. According to Grand View Research, the biotech market is projected to grow at a compound annual growth rate (CAGR) of 13.96% from 2023 to 203010, reflecting increased innovation, rising healthcare demands, and greater investment in life sciences. This growth environment creates a compelling backdrop for Medicus Pharma’s acquisition strategy, allowing the company to capitalize on high-potential opportunities within the sector.

The following diagram illustrates the biotech industry’s expected expansion up to 2030.

Acquisition Strategy

Medicus Pharma (Nasdaq: MDCX) is focused on identifying and acquiring private biotech companies that align with its growth strategy. Many of these private firms trade at lower valuations due to limited access to capital, fewer regulatory requirements, and lower visibility in the market.

According to data from valuation expert Aswath Damodaran (January 2025), private biotech companies with under $1 million in EBITDA were valued at approximately 3.6 times EBITDA, whereas publicly traded U.S. biotech and medical research firms had an average valuation of 22.68 times EBITDA11.

Medicus Pharma’s acquisition strategy seeks to capitalize on these market dynamics by integrating select private biotech companies, like SkinJect, into its public platform. Future acquisitions will be evaluated based on their strategic fit and potential contribution to Medicus Pharma’s overall business objectives.

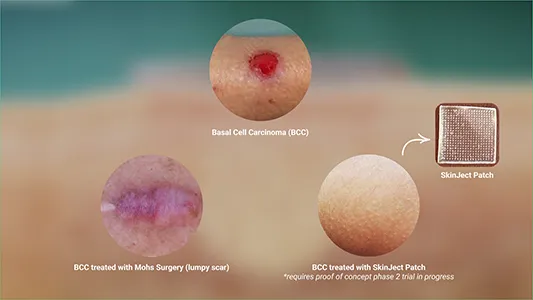

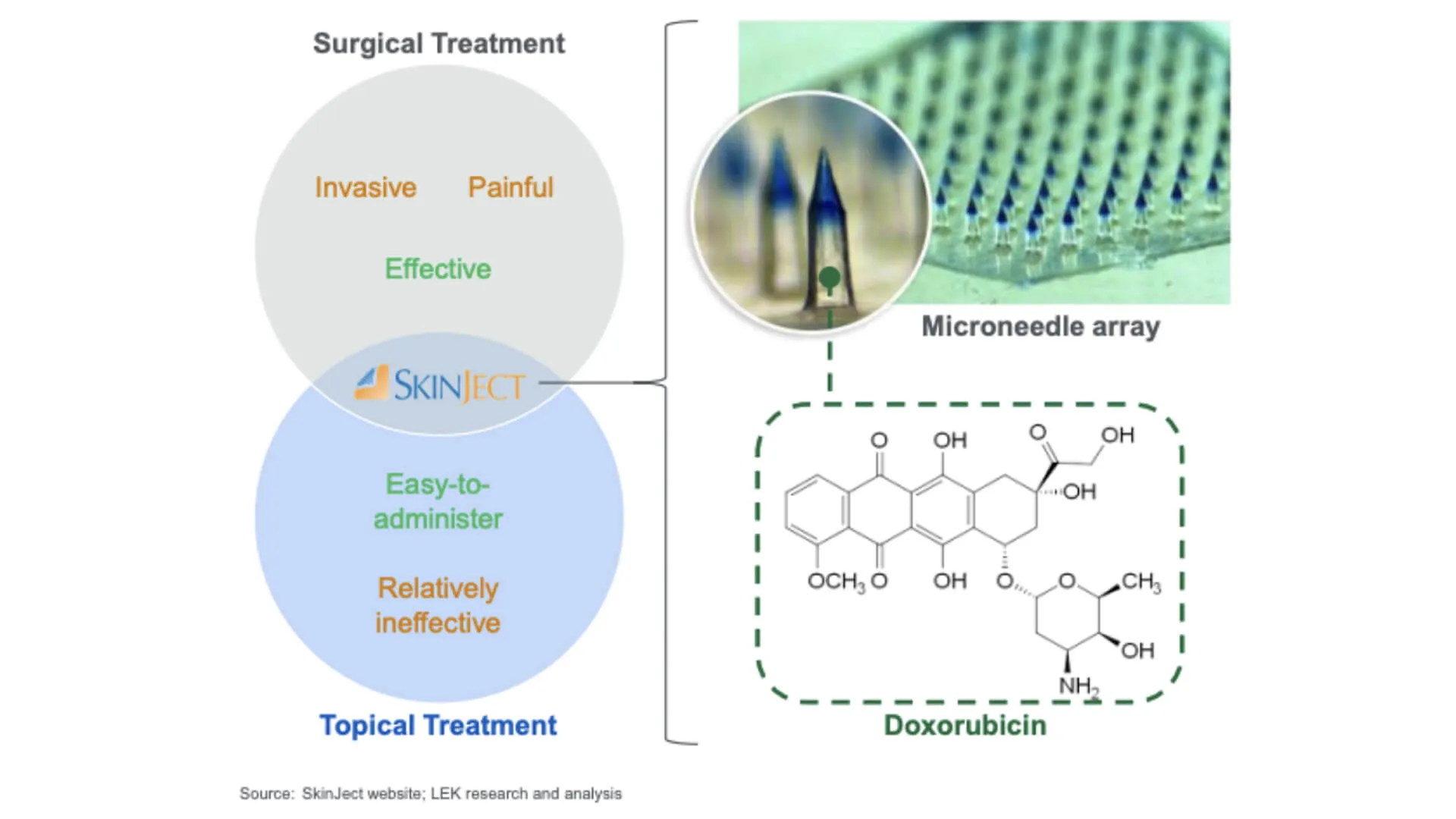

Innovative Cancer Treatment

Medicus Pharma’s SkinJect patch presents a viable and convenient alternative to the current standard of care for BCC, which is Mohs surgery. While Mohs surgery is effective, it is costly, painful and can leave aesthetic concerns.

SkinJect’s skin absorption delivery method directly targets cancer cells, minimizing systemic exposure and side effects. This also means there is the potential to prevent recurrence by stimulating an immunogenic reaction. Therefore, SkinJect could provide a complementary, non-invasive alternative to Mohs surgery.

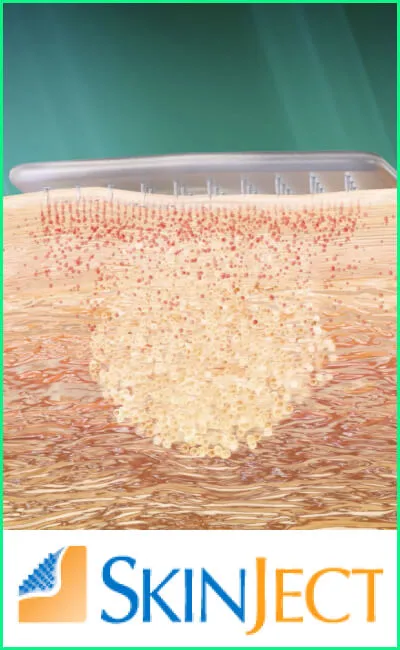

SkinJect: How it works

The SkinJect solution uses microneedle arrays to deliver a chemotherapeutic agent directly to the cancerous lesion.

Microneedle Patch Application

A small, thumb-sized microneedle patch is applied to the skin over the lesion.

The patch is painless and easy to administer in a doctor’s office.

The SkinJect patch can be applied during three weekly 30 minute office visits over 2 weeks.

Drug Delivery Mechanism

The microneedles penetrate the skin and dissolve, releasing treatment directly into the cancerous tissue.

This allows targeted chemotherapy, reducing systemic side effects.

Cancer Cell Destruction

The chemotherapy compound induces apoptosis (programmed cell death) in BCC cells.

It also stimulates an immune response to help eliminate the cancer.

Potential Immune Memory Effect

The immune activation may prevent recurrence by training the immune system to recognize and attack future BCC cells.

This could provide a long-term benefit beyond the initial treatment.

Competitor Analysis

Unlike other developing therapies, SkinJect is the only fully dissolvable microneedle patch currently in Phase 2 trials for BCC. For this reason, its novel solution doesn’t have a comparable product with regard to its method of treatment.

Other methods of treating BCC exist on the market, but Medicus Pharma believes its SkinJect product has added patient and cost benefits over the other treatments:

Medicus Pharma’s Unique Selling Proposition for retail investors:

Feature | Medicus Pharma (MDCX) | Traditional BCC Treatment |

|---|---|---|

Method | Non-invasive microneedle patch | Surgical removal |

Typical Time to Complete Treatment | 21 Days2 | 215 days8 |

Procedure Time | 3 x 30 min/session over 2 weeks | 2-4 hours |

Aesthetic Impact | No scarring | Scarring common |

Immune Activation | Yes | None |

Projected Cost | $1,000 (Estimate)2 | $1,800-$2,500+2 |

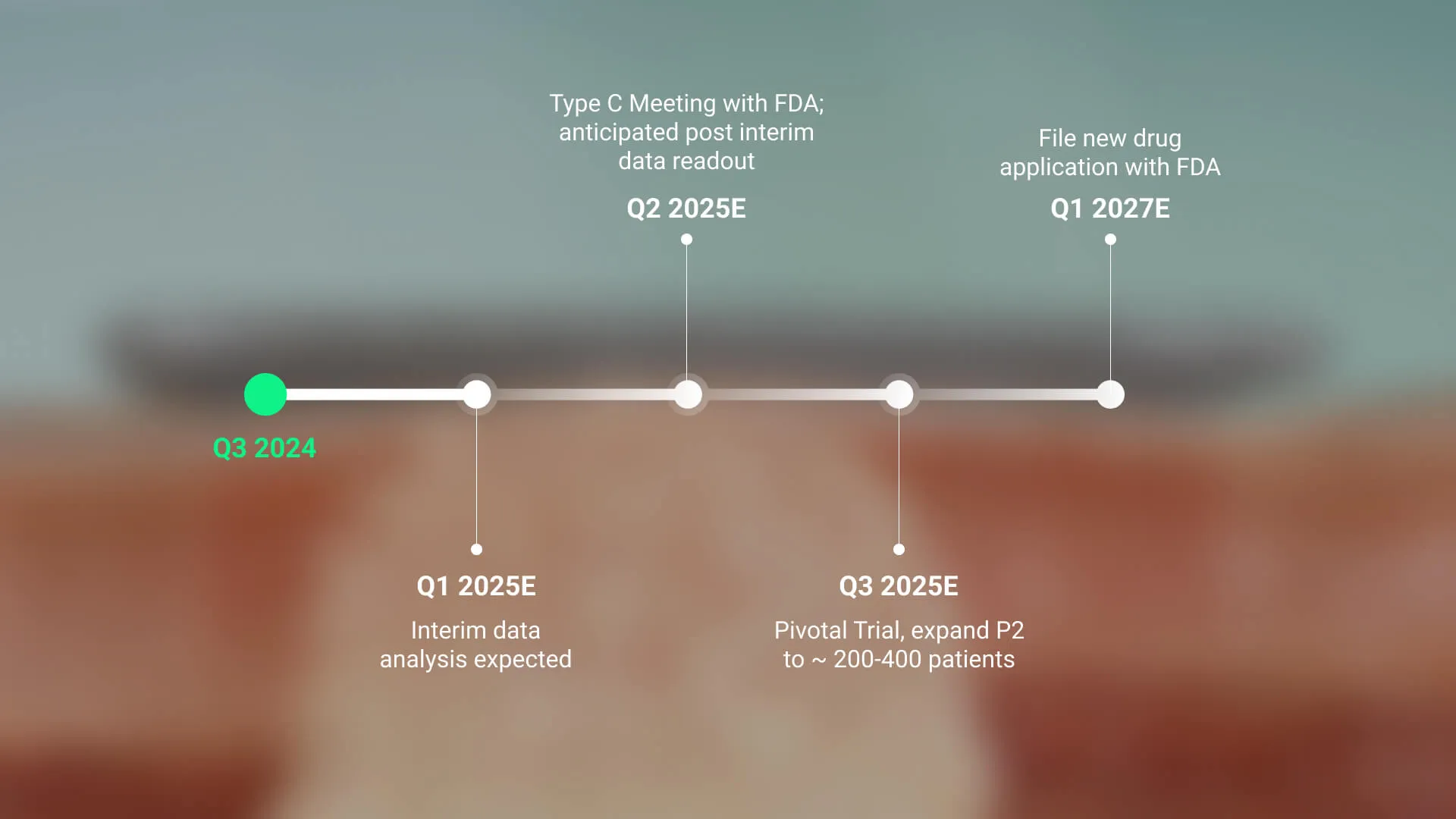

Clinical Development Outlook

Q1, 2025: An interim data readout is expected before the end of Q1, 2025.

Q2, 2025: Type C FDA meeting could expedite review for its novel, non-invasive BCC therapy.

Q3, 2025: Pivotal Trial, expand Phase 2 to between 200 and 400 patients.

Q1, 2027: File new drug application with FDA.

The company expects an interim data readout by the end of Q1 2025, followed by a Type C FDA meeting in Q2 that could expedite the review for its non-invasive BCC therapy. It is pursuing Fast Track designation to accelerate approval and market entry, while a potential pivotal trial reclassification could further streamline regulatory milestones and commercialization.

Robust Financial Position

Capital raised: Over $21 million to date

Institutional ownership: 59.2%

Insider ownership: 10.88%, with the CEO personally investing nearly $4M

No long-term debt: Strong financial flexibility

Recent financing: Raised $16M in 2024, sufficient cash for Phase 2 completion

Independent analysts, Maxim Group and Brookline Capital Markets have issued price targets of $10 & $124, reflecting potential upside based on clinical progress, expected market share, and regulatory approvals. These estimates assume successful commercialization by 2027 and represent a potential 4x return from the current share price of $2.90 on March 4, 2025. Their optimism stems from the company's ability to price its treatment at around $1,000, making it a cost-effective alternative to Mohs surgery, which typically ranges from $1,800 to $2,500 per procedure.

(Note: Analyst targets are based on projections and assumptions that may not materialize.)

Key Considerations

While Medicus Pharma sees strong potential for its SkinJect patch, investors should consider standard clinical and regulatory risks associated with drug development. The company is advancing through Phase 2 trials, but regulatory approvals are complex and not guaranteed. Additionally, market adoption will depend on physician acceptance and insurance coverage.

However, Medicus’ experienced leadership team, strategic financial planning, and strong IP portfolio help mitigate these risks. The management and board bring deep industry experience from the world’s top pharmaceutical companies, ensuring strategic execution. As investor-operators, they are closely aligned with shareholder interests.

By leveraging the expedited FDA route to commercialization, the company anticipates a commercially viable product to market by late 2027.

Experienced Leadership Team

Medicus Pharma is led by an experienced management team and board with around 200 years of collective expertise in drug development, biotech, big pharma, and capital markets. As investor-operators, they are strongly aligned with shareholder interests. The CEO personally invested nearly $4 million, and management also has a notable stake. There are no preferred shares or special deals—everyone holds the same NASDAQ-traded shares. Some of the management and board members include:

Raza Bokhari, MD, Executive Chairman & CEO: A life sciences serial entrepreneur with a strong record of building and leading companies in this space.

Dr. Faisal Mahmud, MD, CMO: Pharmaceutical executive with 20+ years at GSK, Pfizer, BMS, Novartis, and Sanofi, specializing in clinical development and drug safety and a leader in medical affairs.

Edward Brennan, MD, FACS (Chief Scientific Officer): Experienced in R&D with 25+ years in drug development at Wyeth, GSK, and IndiPharm leading clinical programs resulting in 10 FDA approvals.

Carolyn Bonner (President): is a healthcare executive with expertise in sales, marketing, and strategic planning. She led Parkway Clinical Laboratories and held key roles at PLUS Diagnostics and Rosetta Genomics.

Maryann Adesso (Chief of Staff): has worked alongside Dr. Raza Bokhari since 2004, supporting his business ventures. She was Corporate Secretary at FSD Pharma and has experience in investor relations and corporate governance.

James Quinlan, CPA (CFO): Financial services executive and former Partner at Wipfli, LLP. He led tax and wealth advisory for the Mid-Atlantic region and held leadership roles at Smart Financial Advisors and Beneficial Advisors.

Viktoriia Slepeniuk, VP, Investor Relations: multi-talented professional, with a depth of experience in investor relations, trading on Wall Street and previously Vice President, Strategic Initiatives, at Parkway Clinical Laboratories.

Management includes industry veterans from Pfizer, Novartis, Eli Lilly, Amgen, and Siemens Health Solutions, providing strong governance and strategic insight. As investor-operators, the management and board are strongly aligned with shareholder interests.

5M+ Cases. $15B Market. A Novel Targeted Non-Invasive Solution.

Medicus Pharma’s SkinJect patch is addressing a critical unmet need in a rapidly growing market. With a strong regulatory strategy and a focus on de-risking, the company is positioned for success. Are you ready to invest?

Sources:

1. Skin Cancer Foundation. Basal Cell Carcinoma Overview The Most Common Skin Cancer. Accessed February 2025. https://www.skincancer.org/skin-cancer-information/basal-cell-carcinoma/

2. Medicus Pharma Investor Presentation, Q1 2025. Accessed February 2025. https://medicuspharma.com/investor-relations/presentations/

3. Medicus Pharma. Accessed February 2025. https://medicuspharma.com

4. Analyst Coverage from Maxim Group, 17 Dec 2024, and Brookline Capital Markets, 23 Dec 2024. Both reports were supplied by Medicus Pharma in February 2025.

(Note: Analyst targets are based on projections and assumptions that may not materialize.)

5. Medicus Pharma Provides Update on SKNJCT-003 Phase 2 Clinical Study for the Treatment of Nodular Basal Cell Carcinoma (BCC). https://medicuspharma.com/medicus-pharma-provides-update-on-sknjct-003-phase-2-clinical-study-for-the-treatment-of-nodular-basal-cell-carcinoma-bcc/

6. Zacks Small-Cap Research. September 24, 2024. https://s27.q4cdn.com/906368049/files/News/2024/Zacks_SCR_Research_09242024_V-MDCX_Ralston.pdf

7. Science Direct. Overview of skin cancer types and prevalence rates across continents. August 8, 2024. https://www.sciencedirect.com/science/article/pii/S2949713224000582#bib94

8. Neurology Advisor. Mohs Micrographic Surgery Providers Are Not Accessible in Most US Counties. https://www.neurologyadvisor.com/news/mohs-micrographic-surgery-providers-are-not-accessible-in-most-us-counties/

9. PubMed. Waiting time for Mohs Micrographic Surgery and the associated increase in lesion size of basal cell carcinoma. https://pubmed.ncbi.nlm.nih.gov/35794062/

10. Grand View Research. Global biotechnology market, 2018-2030 (US$M). https://www.grandviewresearch.com/horizon/outlook/biotechnology-market-size/global

11. Equidam. EBITDA Multiples by Industry in 2025. https://www.equidam.com/ebitda-multiples-trbc-industries/

Important Notice And Disclaimer

PAID ADVERTISEMENT

This communication is a paid advertisement. ValueTheMarkets is a trading name of Digitonic Ltd, and its owners, directors, officers, employees, affiliates, agents and assigns (collectively the “Publisher”) is often paid by one or more of the profiled companies or a third party to disseminate these types of communications. In this case, the Publisher has been compensated by Medicus Pharma to conduct investor awareness advertising and marketing and has paid the Publisher the equivalent of one hundred and seventy five thousand US dollars starting 3rd March 2025 for a period of 4 weeks until 28th March 2025 to produce and disseminate this and other similar articles and certain related banner advertisements. This compensation should be viewed as a major conflict with the Publisher’s ability to provide unbiased information or opinion.

CHANGES IN SHARE TRADING AND PRICE

Readers should beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you receive this communication, which has the potential to adversely affect share prices. Frequently companies profiled in our articles experience a large increase in share trading volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in share trading volume and share price may likely occur.

NO OFFER TO SELL OR BUY SECURITIES

This communication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security.

INFORMATION

Neither this communication nor the Publisher purport to provide a complete analysis of any company or its financial position.

This communication is based on information generally available to the public and on an interview conducted with the company’s CEO, and does not contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, the Publisher does not guarantee the accuracy or completeness of the information. Further, the information in this communication is not updated after publication and may become inaccurate or outdated. No reliance should be placed on the price or statistics information and no responsibility or liability is accepted for any error or inaccuracy. Any statements made should not be taken as an endorsement of analyst views.

NO FINANCIAL ADVICE

The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser or a financial adviser. The Publisher has no access to non-public information about publicly traded companies. The information provided is general and impersonal, and is not tailored to any particular individual’s financial situation or investment objective(s) and this communication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor or a personal recommendation to deal or invest in any particular company or product. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the advertised company’s SEC, SEDAR+ and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk. Past performance does not guarantee future results.

FORWARD LOOKING STATEMENTS

This communication contains forward-looking statements, including statements regarding expected continual growth of the featured companies and/or industry. Statements in this communication that look forward in time, which include everything other than historical information, are based on assumptions and estimates by our content providers and involve risks and uncertainties that may affect the profiled company’s actual results of operations. These statements involve known and unknown risks, uncertainties and other important factors that could cause the actual results and performance to differ materially from any future results or performance expressed or implied in the forward-looking statements. These risks, uncertainties and other factors include, among others: the success of the profiled company’s operations; the size and growth of the market for the company’s products and services; the company’s ability to fund its capital requirements in the near term and long term; pricing pressures; changes in business strategy, practices or customer relationships; general worldwide economic and business conditions; currency exchange and interest rate fluctuations; government, statutory, regulatory or administrative initiatives affecting the company’s business.

INDEMNIFICATION/RELEASE OF LIABILITY

By reading this communication, you acknowledge that you have read and understand this disclaimer in full, and agree and accept that the Publisher provides no warranty in respect of the communication or the profiled company and accepts no liability whatsoever. You acknowledge and accept this disclaimer and that, to the greatest extent permitted under applicable law, you release and hold harmless the Publisher from any and all liability, damages, injury and adverse consequences arising from your use of this communication. You further agree that you are solely responsible for any financial outcome related to or arising from your investment decisions.

TERMS OF USE AND DISCLAIMER

By reading this communication you agree that you have reviewed and fully agree to the Terms of Use found here https://www.valuethemarkets.com/terms-conditions/ and acknowledge that you have reviewed the Disclaimer found here https://www.valuethemarkets.com/disclaimer/. If you do not agree to the Terms of Use, please contact valuethemarkets.com to discontinue receiving future communications.

INTELLECTUAL PROPERTY

All trademarks used in this communication are the property of their respective trademark holders. Other than valuethemarkets.com, the Publisher is not affiliated, connected, or associated with, and the communication is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks other than valuethemarkets.com.

AUTHORS: VALUETHEMARKETS

valuethemarkets.com and Digitonic Ltd and our affiliates are not responsible for the content or accuracy of this article. The information included in this article is based solely on information provided by the company or companies mentioned above. This article does not provide any financial advice and is not a recommendation to deal in any securities or product. News and research are not recommendations to deal, and investments may fall in value so that you could lose some or all of your investment. Past performance is not an indicator of future performance.

ValueTheMarkets do not hold any position in the stock(s) and/or financial instrument(s) mentioned in the above piece. ValueTheMarkets have been paid to produce this piece by the company or companies mentioned above. Digitonic Ltd, the owner of valuethemarkets.com, has been paid for the production of this piece by the company or companies mentioned above.