Microsoft (NASDAQ: MSFT) is due to publish its fiscal year 2022 Q1 earnings on October 26, 2021. Q4 earnings were great and much better than expected for a company of its size. With upbeat guidance posted for Q1, shareholders are hopeful it will impress once again.

#Recap of Q4 earnings

Microsoft’s three operating segments include Intelligent Cloud, Productivity and Business Processes, and More Personal Computing.

During Q4, Microsoft’s Intelligent Cloud revenue, rose 30%. The Personal Computing segment, rose 9%, and Productivity and Business Processes revenues rose 25%.

Microsoft is focused on digital transformation as it scales its cloud offerings. In Q4, Azure’s revenues had risen 51% year-over-year. The purpose of Microsoft Cloud is to serve clients in the best way possible, with a multitude of cloud-based solutions. These include employee collaboration, supply chain management, Azure infrastructure, and developer tools.

The work-from-home phenomenon has been a boon for its Teams cloud-based communications software. As of Q4 earnings, Teams had close to 250 million monthly active users. Microsoft's Commercial Cloud revenue rose 36% year-over-year.

After several years of limited revenue generation, LinkedIn surprised investors with a 46% jump in sales, with ad revenue finally surpassing $1 billion. Furthermore, Xbox also enjoyed impressive growth.

During Q4 Microsoft bought back $7.2 billion worth of stock. Buybacks like this are a great incentive to shareholders to stay committed because they increase the value of the stock being held.

Some of Microsoft’s Q4 earnings highlights:

Revenue was $46.2 billion and increased 21%

Operating income was $19.1 billion and increased 42%

Net income was $16.5 billion and increased 47%

Diluted earnings per share was $2.17 and increased 49%

#Gearing up for a new financial year

After Microsoft’s upbeat Q4 earnings call in July, several analysts raised their MSFT share price target.

According to FactSet, 33 Analysts provide a consensus target price of $335.47 for MSFT stock, offering a potential 8.5% upside.

Earnings per share (EPS) for full-year 2022 are expected to reach $8.83.

In full-year 2021, Microsoft’s operating income and margin profited from two factors that won’t be repeated in the coming year. Firstly, a change in accounting estimate for the useful life of server and network equipment led to $2.7 billion of depreciation expense, which will shift to future periods. The second factor was a saving of $1.2 billion in operating expenses from COVID-19-related restrictions, which will gradually reduce in the coming months.

The gross margin percentage for commercial cloud division is affected by three ever-present factors.

revenue mix shift to Azure

increased usage of cloud services

ongoing strategic investments to support customer success

Meanwhile, capital expenditures will continue to grow as the firm invests in meeting rising global demand for its cloud services.

In Microsoft’s July Q4 Earnings Call, Chief Financial Officer, Amy Hood, said:

#Microsoft’s Segment guidance for Q1, 2022

Productivity and Business Processes

Microsoft expects revenue in its Productivity and Business Processes segment to come in between $14.5 billion and $14.75 billion – This beats analyst projections of $14.1 billion.

Office Commercial: continued revenue growth, driven by Office 365.

On-premises business: revenue decline of 20%, consistent with customer shift to the cloud.

Office Consumer: high single-digit revenue growth with continued momentum in Microsoft 365 consumer subscriptions.

LinkedIn: revenue growth in the high-30% range.

Dynamics: revenue growth in the high 20s.

Intelligent Cloud

Expectations for Microsoft’s Intelligent Cloud division project revenues between $16.4 billion and $16.65 billion. Again, this beats analyst projections of $15.7 billion.

Azure: revenue growth should remain relatively stable on a sequential basis.

On-premises server business: revenue growth in the high single digits.

Enterprise Services: revenue in the high single digits.

More Personal Computing

In the More Personal Computing segment revenue outlook is $12.4 billion to $12.8 billion – this falls in line with analyst estimates of $12.7 billion. A deferral in Windows 11 revenue from Q1 to Q2 will equate to around $300 million, which is a 10-point estimated negative impact.

OEM (original equipment manufacturer) revenue is expected to decline in mid-to-high single digits in Q1.

Microsoft Surface: revenue to decline in the low teens while dealing with supply chain challenges.

Windows Commercial products and cloud services: healthy double-digit growth.

Search excluding traffic acquisition costs (TAC): revenue growth in the high 30s driven by improvements in the advertising market.

Gaming: revenue growth in the low double digits. Console growth will again be constrained by supply. And on a strong prior year comparable, Xbox content and services revenue should grow low single digits.

Company guidance:

Cost of goods sold (COGS): $13.55 billion to $13.75 billion

Operating expense of $11.6 billion to $11.7 billion.

Other income and expense: interest income and expense should offset each other.

Q1 tax rate to be approximately 16%

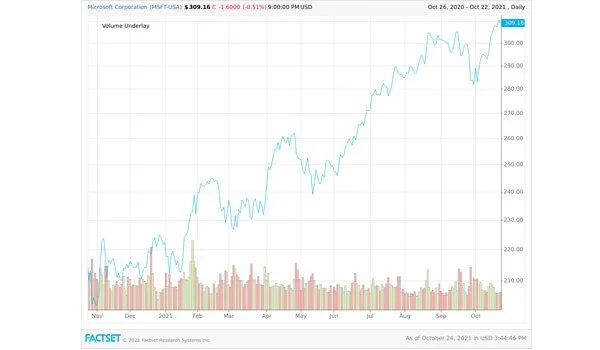

Overall, the Microsoft team remains optimistic in its expectations for Q1 earnings results. This has helped drive the MSFT share price higher in recent weeks.

#A new chapter

Along with its well-known products and services, Microsoft is advancing in artificial intelligence (AI), augmented reality (AR) and virtual reality (VR).

Scott Guthrie, EVP of Microsoft Cloud and AI, recently said:

This illustrates the potential for continued growth and breakthrough tech adoption. Indeed the HoloLens virtual reality headsets are being rolled out to the US Army in a $22 billion project. Unfortunately, the project has been delayed until later next year.

Meanwhile, In the Q4 earnings call Chairman and CEO Satya Nadella said:

#Macro environment

Tech stocks appear to be on shaky ground as iOS privacy updates and antitrust crackdowns are fuelling negative press. Microsoft is less exposed to negative press than its FAANG counterparts Facebook (NASDAQ: FB), Apple (NASDAQ: AAPL), Amazon (NASDAQ: AMZN), and Google (Alphabet (NASDAQ: GOOGL)) but it’s not entirely immune.

Like its Big Tech peers, Microsoft enjoys extensive free cash flow reserves, meaning it is in a prime position to make strategic acquisitions. Shareholders often respond well to M&A because it increases the growth opportunity, adding value to the stock.

Macro factors that may affect the overall stock market include a vote on the infrastructure bill and climate policy changes. President Biden’s infrastructure bill was approved earlier in the year but has been held up. The $1.2 trillion package is intended to improve roads, bridges, pipes, ports, and Internet connections.

Meanwhile COP26 in Glasgow begins on October 31 and is expected to bring harsh changes to climate policies around the world.

Furthermore, inflation concerns and supply chain logjams are also worrying investors.

MSFT is not a bargain stock. Its price-to-earnings ratio (P/E) is 35x and its price-to-book ratio (P/B) is 16. Investors are happy to pay up for better quality stocks when considering the long game. Microsoft is one of these high-quality companies. It also offers shareholders a 0.8% dividend yield.

Microsoft is focused on driving revenue growth while investing in strategic high-growth opportunities. Its outlook for the coming full-year projects strong operating margins.

To help with your investment prep, read our previous article: Is Microsoft a good investment?