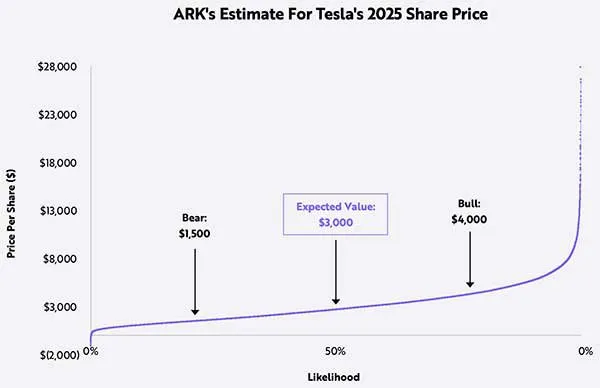

ARK Invest released new Tesla (NASDAQ:TSLA) share price targets last week, and it sent Tesla bulls into a frenzy. The ARK team don’t just see a bright future for Tesla, they appear to predict an unprecedented uprising. In fact, The Tesla bear case presented by ARK is a share price of $1,500 (questionably bearish), base case $3,000 a share by 2025 and bull case $4,000 per share.

#An optimistic outlook

This incredibly optimistic outlook is based on consumers adapting an Airbnb style model for their vehicles, lending them out as a car-sharing money-spinner. ARK’s thesis foresees 60% of Tesla owners lending their cars for autonomous taxi services. That’s a very high percentage, and many analysts think it’s ludicrous to expect anything over 10%.

Based on deeper research into Tesla’s #battery technology, its #AI breakthroughs, and its #ride-hailing possibilities, @TashaARK has pulled together and updated our $TSLA model with great input from @skorusARK and guidance from @wintonARK. Thank you for your tireless research! https://t.co/xyJ17uQnHV

— Cathie Wood (@CathieDWood) March 20, 2021

Tesla’s #battery technology, #AI breakthroughs, and #ride-hailing

Nevertheless, who are we to knock ARK’s judgement? Cathie Wood’s track record has astounded investors and analysts globally. Arguably, many invested in ARK’s funds were simply along for the ride, without ever being fully confident in her ability to pull off her projections.

But prove herself right she did. Back in 2018 Cathie Wood predicted the Tesla share price would hit $4,000 by 2023. Very few believed her at the time because Tesla was facing many serious issues. It was struggling to scale production of its Model 3, had quality control problems and a liquidity challenge that made many analysts concerned it was heading for bankruptcy.

Fast forward three years and it surpassed that $4,000 target on a split-adjusted basis when it rose above $816 (Tesla implemented a 5-for-1 stock split last year). It’s back below there today as the US tech sector has been enduring a sell-off across the board, but ARK’s new price targets are sure to send it soaring once more as investor confidence is bolstered once again.

So, Cathie Wood is not afraid of having to defend her outlandish forecasts and ARK Invests models are built to withstand the intense scrutiny coming from all angles.

#Déjà vu

The Tesla share price speculation bears an eerie resemblance to Apple’s rise back when smartphones were new. Few believed Apple (NASDAQ: AAPL) could pull-off the sales projections they were making at the outset.

Investor sentiment was low, and headlines screamed “IBM will crush Apple!”, “Nokia/Eriksson own this space”, “How will Apple ever get consumers to switch from Blackberry?” etc. But look at it now!

Apple is a two-trillion-dollar company with an insanely strong brand and business and none of those other companies come close to touching it in market cap and revenues.

#Bull reasons Tesla share price could rise

The Tesla bull train has been building momentum in recent years, and so many of those investors are not going to back down now. For many of them, it’s not just the quality or style of the vehicle, it’s all about the future vision for the company. And much of that is based on their belief that Elon Musk’s genius will bring great things to those that believe in him.

Artificial intelligence potential

Cathie Wood tweeted: “Oh yes, I forgot to mention how scarce exponential growth opportunities are likely to become as #artificialintelligence creates more winner-take-most opportunities like autonomous taxi networks!”

She’s very bullish on artificial intelligence and its insane capabilities to disrupt the world.

Elon Musk replied to her tweet: “When vast amounts of manufacturing are needed, as in robotaxis, this slows down rate of introduction, so maybe more like winner-takes-a-quarter. Still great.”

Perhaps trying to tone her enthusiasm down a little, so as not to get carried away on the exponential rise. But in any case, they’re both confident Tesla has a bright and busy future.

Oh yes, I forgot to mention how scarce exponential growth opportunities are likely to become as #artificialintelligence creates more winner-take-most opportunities like autonomous taxi networks!

— Cathie Wood (@CathieDWood) March 20, 2021

Cathie Wood on Tesla Artificial Intelligence possibilities

Insurance business

ARK Invest’s bull case presents Tesla selling 10 Million cars in 2025 and achieving a $4 Trillion Market Cap. ARK’s case also accounts for Tesla’s insurance business, which could see Tesla owners getting cheaper insurance premiums based on the way they drive. Plus, it increased the probability that Tesla will achieve full autonomous driving to 40% by 2025.

Battery Tech

ARK lowered gross capital expenditure per car to account for superior cell chemistry and manufacturing in Tesla batteries. At Tesla’s Battery Day last year, it announced its improved processes should reduce investment costs by 75% in time.

Ride-hailing opportunities

In its least optimistic outlook, ARK believes Tesla’s ride-hail could add $20 billion to its operating profit by 2025. This would be a precursor to its robotaxi service.

In the event Tesla introduces fully autonomous ride-hailing, which ARK estimates with 50% probability by 2025, the ARK projects Tesla could generate an additional $160 billion in EBITDA in 2025.

Source: ARK Invest – Estimate for Tesla’s 2025 share price

#Bear reasons Tesla share price could fall

Tesla has serious competition in the EV market. Some hot EV stocks that have endured extreme share price action in the past year include NIO, Lucid Motors, Geely, Xpeng, and Canoo, to name a few.

Competition is rising

But now the old-timers are getting in on the action. Volkswagen is on a mission to overtake Tesla as the world’s most successful electric vehicle company. Last week it signed a deal with BP to provide charging stations throughout Europe.

Some investors see Volkswagen as a much better EV bargain than Tesla. It has a $130 billion market cap, while Tesla’s is $700 billion. Whereas VW’s revenues and earnings have far surpassed Tesla’s for years.

During 2019, Volkswagen generated revenue of €252.6 billion. This fell a disappointing 11.8% to €222.9 billion in 2020, which was understandable considering the impact the Covid-19 pandemic had on the auto industry. Meanwhile, Tesla’s 2020 revenue was around $31.5 billion, up from $24.6 billion in 2019.

Then there’s General Motors with its $86 billion market cap and 2020 revenues of $122.5 billion. GM has committed to spending $27 billion in manufacturing 30 electric vehicles by 2025. IT’s also building a US based battery manufacturing plant. Some of its current models include the Cadillac LYRIQ show car, the GMC HUMMER EV, the Chevrolet Bolt EV, and the Cruise Origin.

Safety concerns

And it’s not just competition that worries Tesla bears. The cars themselves have been coming under fire for safety reasons. In fact, US safety regulators are investigating 23 Tesla crashes according to a Reuters report. Some of these are believed to involve the Tesla Autopilot program, but it’s not yet clear if they all do.

Spying capabilities

Last week Elon Musk said Tesla would be shut down if its cars were used to spy. This comes after China’s military banned Teslas from its facilities on account of security concerns over cameras installed on the vehicles.

Carbon credit reliance

Tesla’s profits are thought to be in large part thanks to carbon credits provided by the government. In the near-term this is likely to continue and maybe even increase, but long-term analysts question whether it’s a sustainable income stream.

Bitcoin buy

And another reason for negative sentiment is Tesla’s big bitcoin buy earlier this year. Not everyone is happy that Tesla is putting some of its balance sheet into bitcoin.

Tesla’s action is not directly reflective of my opinion. Having some Bitcoin, which is simply a less dumb form of liquidity than cash, is adventurous enough for an S&P500 company.

— Elon Musk (@elonmusk) February 19, 2021

Elon Musk on Tesla’s Bitcoin buy

Speculation and hype

Then there’s the fact some analysts simply believe Tesla’s success is all based on speculation and hype. Its forward price-to-earnings ratio is an eye-watering 171, which certainly indicates an expensive stock.

Nevertheless, none of these arguments are new and Tesla has continued to defy bears, soldiering on to make higher and higher highs.

#Cathie Wood’s personal fortune

If Cathie Wood’s insanely optimistic Tesla outlook comes true, Elon Musk won’t be the only rich recipient of Tesla’s success. Wood herself will stand to make an incredible fortune from the success of her funds.