Consumer spending is the lifeblood of the US economy, accounting for nearly 70% of GDP1. By understanding how people allocate their money, policymakers, businesses, and investors gain insights into economic health, potential growth opportunities, and looming risks. One of the most useful metrics to analyze this is Real Personal Consumption Expenditures (PCE), which measures inflation-adjusted spending on goods and services. Here we look at the key personal consumption trends from 2020 to 2024, exploring how spending habits evolved and what it means for the broader economy. For investors, these spending patterns reveal which sectors are gaining momentum and could influence future stock market performance.

#Consumer Spending Recovery Post-2020

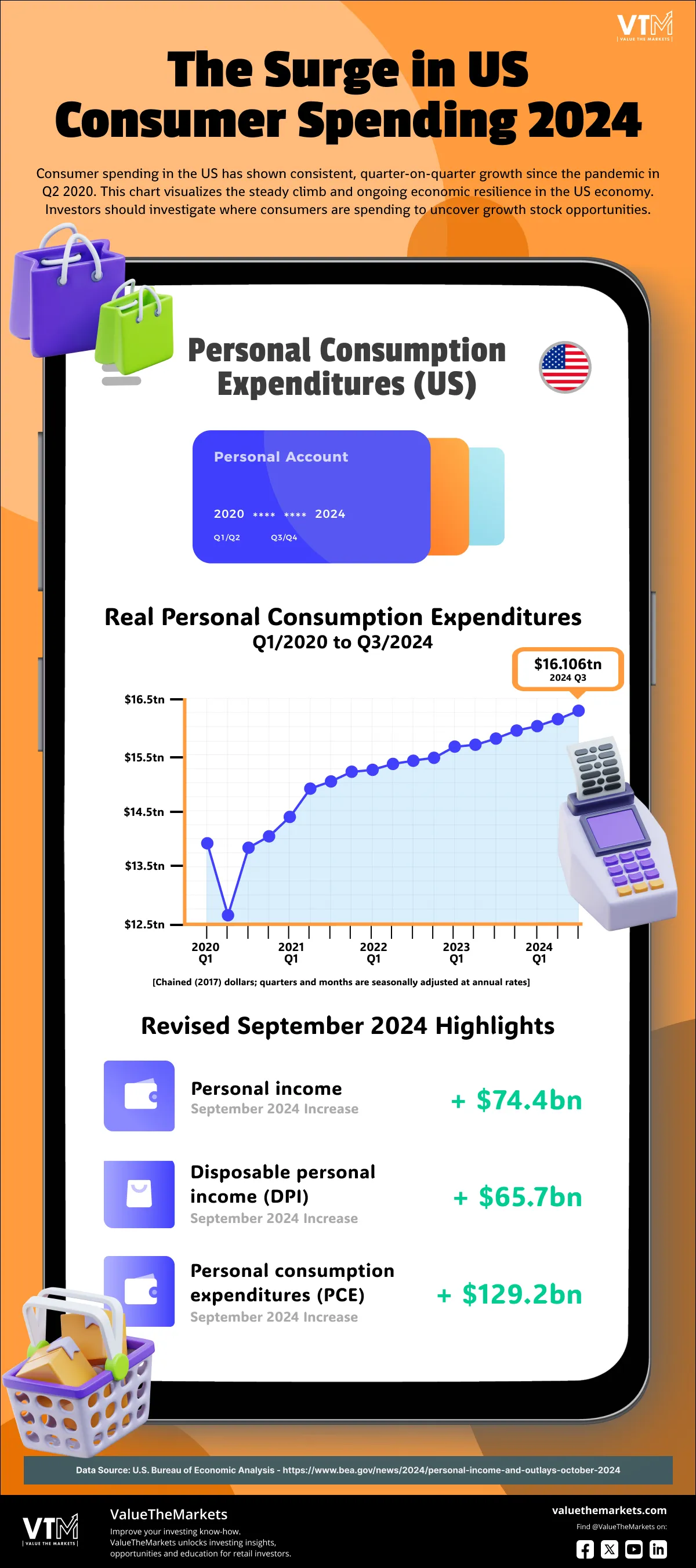

The early months of 2020 marked a sharp decline in consumer spending due to the COVID-19 pandemic. Lockdowns, widespread unemployment, and uncertainty forced households to cut back, particularly on discretionary purchases like dining out, travel, and entertainment. Durable goods spending also dropped as major purchases were delayed. However, as the economy reopened and government stimulus payments bolstered household finances, spending rebounded rapidly in the third quarter of 2020.

By late 2021, consumer spending surpassed pre-pandemic levels, fueled by pent-up demand and increased savings from reduced activity earlier in the pandemic. This recovery was uneven across categories. While durable goods saw a significant spike—think of people upgrading home appliances or purchasing vehicles during the remote-work boom—services like travel and dining out took longer to recover.

In this type of spending environment, retail investors might look for growth opportunities in industries seeing rising demand, such as home entertainment or e-commerce, which continue to adapt to evolving consumer habits.

#Steady Growth in Key Categories

Over the last few years, personal consumption expenditures have grown consistently, with some categories standing out as key drivers:

Durable Goods: Spending on items like cars and appliances surged during the pandemic as households redirected funds typically spent on services toward goods. This trend slowed in later years as supply chain disruptions eased and pent-up demand normalized.

Nondurable Goods: Categories like groceries and clothing saw steady growth, partly due to inflation but also reflecting shifts in consumer preferences, such as higher spending on organic or premium products.

Services: By 2022, services spending returned to growth, driven by increased demand for travel, entertainment, and healthcare.

Services now dominate total PCE, comprising about two-thirds of all spending. For investors, this dominance suggests that industries tied to experiences, like travel, well-being, or healthcare, may present opportunities for long-term growth.

Investors should monitor whether rising prices in goods and services are reflected in company margins or passed on to consumers. Businesses that sustain margins despite inflationary pressures often exhibit strong competitive advantages, such as economies of scale or proprietary products, making them attractive investment opportunities. If rising prices are passed on to consumers, it suggests that companies have sufficient pricing power to maintain or grow margins without sacrificing sales volume.

For investors, this is often a positive sign, as it reflects a strong brand, loyal customer base, or differentiated offerings that justify higher prices. However, there is a risk to consider—consumer demand may weaken if price increases exceed what the market is willing to bear2.

#Factors Influencing Spending Trends

Several forces shaped consumer spending trends from 2020 to 2024:

Economic Recovery Measures: Government stimulus programs supported essential spending while boosting discretionary categories. However, investors questioned whether companies could sustain growth as stimulus effects faded.

Behavioral Shifts Post-Pandemic: Consumers reprioritized their spending. Home improvement, fitness equipment, and streaming services initially saw spikes during lockdowns, while later years brought increased spending on travel, dining, and entertainment as restrictions eased. Shifts in consumer spending often drive sector rotation, where investors pivot between industries like technology, consumer staples, and services to align with evolving trends.

Inflationary Pressures: Rising prices, particularly in essentials like housing, energy, and food, squeezed household budgets. While real PCE accounts for inflation, it doesn’t capture the full strain on consumers, especially for lower-income households disproportionately affected by price increases.

Employment Recovery: By 2023, robust job growth and wage increases supported higher spending. However, inflation often eroded the real purchasing power of these gains.

Ultimately, investors may find opportunities in companies with strong pricing power that can maintain profitability despite rising costs.

#Seasonal Patterns and Notable Spikes

Seasonal patterns and economic events created spikes and dips in spending over the years:

Holiday Shopping: Fourth-quarter spending surged consistently due to holiday demand, particularly for durable and nondurable goods, making this period critical for retailers. However, supply chain challenges in 2021 disrupted traditional patterns, delaying some purchases into early 2022.

Stimulus Payments: The distribution of stimulus checks in 2020 and 2021 created noticeable spending surges. Categories like electronics, home furnishings, and recreational goods saw sharp gains during these periods.

Fuel and Energy Costs: Fluctuating gas prices, especially in 2022, redirected spending away from discretionary purchases toward essentials.

Learn how to find new and interesting investment opportunities.

#Long-Term Implications for the Economy

The sustained growth in consumer spending reflects the resilience of the US economy but brings challenges:

Economic Stability: Rising consumer spending signals confidence, which supports business expansion and job creation. However, growth driven by borrowing rather than income gains may prove unsustainable.

Inflation and Interest Rates: Persistent inflation and higher interest rates dampen demand for high-cost items like cars and homes, slowing durable goods growth while raising the cost of credit-funded purchases.

Inequality in Spending: PCE data masks disparities—higher-income households drive much of the growth, while lower-income households struggle with essentials like housing and food. Investors can focus on companies catering to high-income luxury consumers or affordable options for cost-conscious households.

#Data Revisions

Data revisions are common, particularly for key economic indicators like personal income, disposable income, and personal consumption expenditures (PCE). These revisions occur because initial estimates are based on incomplete or preliminary data. Recent revisions to September data indicate higher-than-initially-reported figures for personal income, disposable income, and PCE, reflecting stronger-than-expected economic activity. For instance, personal income for September was revised from $71.6 billion to $74.4 billion, while disposable personal income jumped from $57.4 billion to $65.7 billion. Personal consumption expenditures saw the largest upward revision, rising from $105.8 billion to $129.2 billion (0.6%). These adjustments suggest that consumers had more financial flexibility than previously thought, underscoring resilience in the face of inflationary pressures.

The revisions to September's figures and strong growth in October3 indicate a positive trajectory for both income and spending. The notable increase in disposable income suggests that consumers have retained their purchasing power, which may help sustain PCE growth. For investors, these shifts highlight potential opportunities in sectors benefiting from higher consumer activity, such as retail, travel, and financial services. However, a slight deceleration in PCE growth from September to October (0.6% to 0.4%) may indicate early signs of caution among consumers as inflation and higher interest rates take hold.

#Breaking Down Spending by Product Type

To better understand PCE, it’s useful to look at spending by product type:

Durable Goods: These long-lasting items (cars, appliances, furniture) saw volatile trends. During the pandemic, demand surged for home-related products but cooled as supply chains normalized and borrowing costs rose.

Nondurable Goods: This category includes essentials like groceries and fuel, which grew steadily but faced inflationary pressures. Spending on clothing and personal care products showed gradual recovery as in-person activities resumed.

Services: The largest component of PCE, services, includes everything from healthcare to education and financial services. Growth in this area underscores the economy’s shift toward service-based consumption, though rising costs in healthcare and education present challenges.

For investors, durable goods companies could see slower growth in a high-interest-rate environment, while nondurable goods might benefit from their essential nature. Investors should consider how sectors like healthcare or financial services dominate spending trends, indicating consistent demand and potential stability.

#Misleading Aspects of Real PCE

While Real PCE is a useful metric, it has limitations that investors should consider to avoid misinterpretation:

Aggregate Data Masks Variations: High-income households often drive spending growth, masking financial strain among lower-income groups.

Inflation Adjustments May Not Capture Reality: The chained dollars methodology adjusts for inflation, but it may understate the impact of rising costs in specific areas like healthcare or rent.

Focus on Spending vs. Necessity: Rising spending doesn’t necessarily mean economic well-being. If spending is driven by debt rather than income growth, it may signal financial vulnerability.

Services’ Dominance: The heavy weighting of services in PCE can skew overall trends, especially during periods of rising healthcare or education costs.

The evolution of consumer spending from 2020 to 2024 underscores the resilience of the US economy. While durable goods initially surged, services dominated the long-term trajectory, reflecting a shift toward experiences and necessities.

Although income and spending remain robust, shifts in monthly growth rates may signal changing consumer behavior, such as prioritizing essential over discretionary spending. Investors should watch for sector-specific trends and companies that demonstrate resilience in adapting to these dynamics.

To gain a clearer picture, investors should look beyond aggregate PCE data and focus on company-specific performance, especially for firms operating in essential or rapidly growing categories.

Looking ahead, risks like inflation, interest rate hikes, and geopolitical tensions (including tariffs) could disrupt these trends. For investors, staying informed about spending patterns helps identify opportunities and assess market resilience.

Sources

YCharts. US Personal Consumption Expenditures as a Percentage of GDP. November 2024. https://ycharts.com/indicators/personal_consumption_gdp

AP News. Consumers Are Spending, but Wall Street and Businesses Expect a Tighter Squeeze Ahead. June 22, 2023. https://www.valuethemarkets.com/news/consumers-are-spending-but-wall-street-and-businesses-expect-a-tighter-squeeze-ahead

U.S. Bureau of Economic Analysis. Personal Income and Outlays, October 2024. November 27, 2024. https://www.bea.gov/news/2024/personal-income-and-outlays-october-2024

U.S. Bureau of Economic Analysis, "Table 2.4.6U. Real Personal Consumption Expenditures by Type of Product, Chained Dollars" (accessed Wednesday, November 27, 2024).