Payment processing disruptor Square (NASDAQ: SQ) is making headlines after purchasing Australian fintech Afterpay (ASX: APT).

Square will pay $29bn for Afterpay, a buy-now, pay-later (BNPL) start-up and first-mover in the space.

#Buy now, pay later

It seems Square’s bold move is a strategic attempt to cash in on the BNPL mania storming e-commerce sites everywhere.

The trend allows consumers to purchase anything from a pair of shoes to a new fridge freezer on a payment plan.

Consumers love the concept because it involves no external credit checks, no interest, and no fees as long as payments are made on time.

#Enhancing global growth prospects

Square believes this acquisition will open doors to global growth prospects in the budding industry.

Furthermore, the two companies see a natural synergy between them. In essence, it adds tens of billions of addressable gross merchandise volume (GMV) to the business.

Square has already amassed a large group of small and medium-sized merchant clients.

Meanwhile, Afterpay has over 75,000 partners with some impressively large clients onboard. These include well-known names like Target (NYSE: TGT), Bed Bath and Beyond (NASDAQ: BBBY), Shein, Lululemon (NASDAQ: LULU), and Urban Outfitters (NASDAQ: URBN).

Better still, there’s an opportunity for merchants to extend cross-border without much effort.

This adds significant value for both customers and merchants. For instance, a shopper in the UK may want to buy from an Australian retailer. Thanks to Afterpay that becomes a possibility.

Afterpay is called Clearpay in the UK.

In a joint investor presentation, the two companies show a significant global opportunity of $10 trillion in online payments with around a 2% BNPL penetration. This ties in with merchants transitioning to omnichannel platforms using BNPL to increase conversions, attract customers, and raise basket sizes.

#How does Afterpay make money?

Afterpay earns an income from a small percentage of each sale it facilitates. This comes from the merchant.

It doesn’t charge the consumer any interest on their purchases, making it a desirable option. It does, however, charge fees for late payments.

In the past 12 months, 13.1m shoppers used Afterpay, and it has achieved an average App Store rating of 4.9 out of 5 from over a million reviews.

Afterpay went public via IPO in May 2016 at $1 a share. Today it trades around $125 a share. That’s a whopping 12,400% rise in five years.

The company has undoubtedly been a beneficiary of the pandemic-driven surge in online shopping.

Afterpay’s total revenue for FY19 was $189m, rising 83% to around $347m for FY20. This almost doubled again to $693m in FY21.

#Risky business

The business of consumer credit is as old as time. While professional services are a clear improvement on the leg-breaking potential of loan sharks, there’s no doubt it’s a risky business on both sides of the fence.

With a lack of oversight, the lenders could be leaving themselves open to losses.

While buy now, pay later can provide a viable way for consumers to complete home improvement projects on time or pay for a large ticket item like a holiday, there’s less sense in using BNPL to pay for small-value items such as clothes.

The monthly payments could mount up very quickly, and those on low incomes may struggle to keep up.

It’s particularly concerning considering we are living in the wake of extreme economic uncertainty.

In the UK, a group of charities have already been voicing their concerns at the rapid rise of BNPL. And calls for more stringent regulation are mounting.

A recent survey by Fitch analysts noted 31% of US respondents were late with their BNPL payments or incurred a late payment fee.

A bigger concern for investors may be that the large BNPL providers do not have sufficient cash set aside to cover losses.

#What does the future look like for BNPL companies?

Competition is fierce. Laybuy, Splitit, Affirm (NASDAQ: AFRM), Klarna, and PayPal (NASDAQ: PYPL) all operate in the BNPL market, and there are several smaller players too.

But the rise of a bigger player in the market could signify a change of pace. It should certainly be easier for a bigger player to play nice with authorities in meeting regulatory obligations.

However, the rise of BNPL may be a growing concern for credit card companies. That’s because, with ease of access to BNPL, younger shoppers may be less tempted to sign up for credit cards.

#Does Wall Street like Square’s latest acquisition target?

The initial response to the news of Square acquiring Afterpay was mixed.

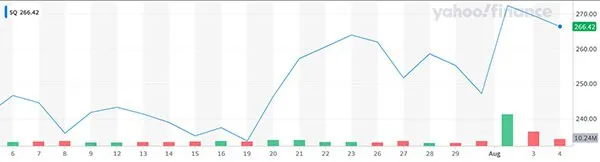

Afterpay’s stock price soared 32% on the news. But Square’s investors were less enthused.

Square’s share price rose around 14% but dropped back around 4.6% since.

Some question such an enormous price tag of $29bn, rather than Square simply building its own version of BNPL. But it’s an all-stock deal, meaning Square doesn’t have to shell out any cash to take ownership.

And founder Jack Dorsey argues that this will help Square move and expand at a much faster pace with leadership that already understands the landscape.

In fact, this is Square’s biggest acquisition to date and the biggest M&A deal the Australian capital markets have ever seen.

The acquisition by one of the world’s most significant fintech disruptors tops a meteoric rise for Afterpay. In a few short years, the company stormed the Australian capital markets, rising to the ASX20 without ever making a profit.

And considering Afterpay’s latest operating update missed analyst estimates, it seems the company and its shareholders are blessed with more than a touch of good fortune.

#Is Square stock a buy?

Square’s CEO and founder is none other than Twitter founder Jack Dorsey.

It recently acquired Spotify-rival Tidal from Jay-Z and its Cash App is a favorite among celebrities and consumers alike.

Ultimately, Square has no shortage of media stars and influencers on board with its publicity campaigns. It seems, being closely aligned with Twitter is no bad thing.

Square has also taken a favorable stance toward cryptocurrency, adding Bitcoin to its balance sheet further enhancing its appeal to a younger generation.

There’s a lot to like about Square and in the fast-moving world of fintech, it appears to be staying ahead of the game.