A FURU stands for Fake Guru. It’s a slang term often used in retail investor social circles online.

A FURU is an individual claiming to be a fountain of stock industry knowledge and wizard-like skills. Unfortunately, a FURU is likened to a con artist or snake oil salesman. The term conveys a ‘self-appointed’ financial guru that appears genuine but can’t necessarily be trusted.

For instance, a FURU will tout various stocks, backed up with genuine statistics, but will alert followers ‘this stock is a must buy’ when the volume is low, and the float (a firm’s available balance – a firm’s book balance) seems high.

The trouble is, the FURU often sells within a few minutes of making this announcement, cashing in on the momentum created by his/her encouragement.

More often than not, this high volume and float were an anomaly created by a brief breakout pattern in the charts that had no real substance behind it.

And the FURU’s followers are left holding the stock or realizing losses as they panic sell. These individuals are often referred to as bag-holders or sheep.

#Beware of hype, self-congratulations, and showmanship

FURU’s are everywhere online. Twitter (NYSE: TWTR), Facebook (NASDAQ: FB), TikTok, Instagram, Snap (NYSE: SNAP), and Reddit all have FURUs.

Alerting people to trades is sometimes called front-running. Some tell-tale signs to look out for include:

The promise you can learn to trade for real

Pics of expensive cars, watches, yachts, mansions, jewellery, and hot vacations

Exclusive (paid for) text message service/Discord/Telegram

Hot stock tips! (with paid trade alert services)

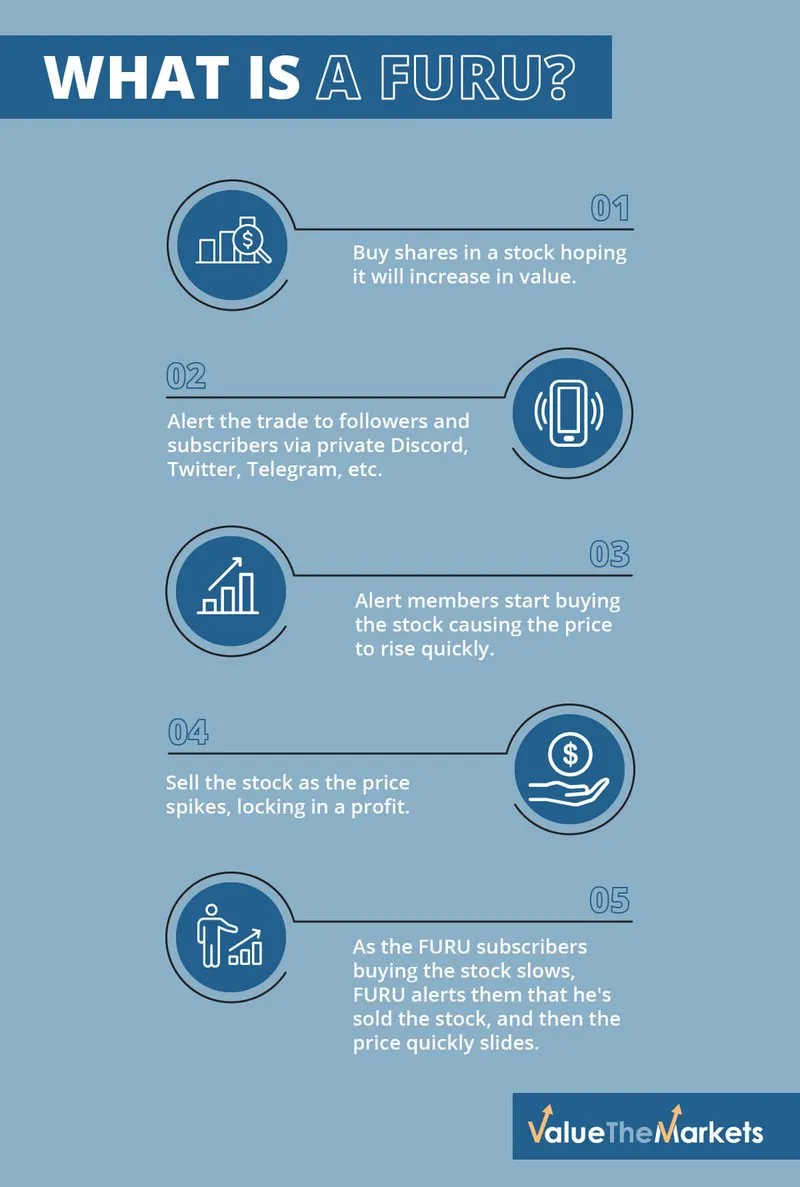

#A FURU gameplan:

Buy shares in a stock hoping it will increase in value.

Alert the trade to followers and subscribers via private Discord, Twitter, Telegram, etc.

Alert members start buying the stock causing the price to rise quickly.

Sell the stock as the price spikes, locking in a profit.

As the FURU subscribers buying the stock slows, FURU alerts them that he’s sold the stock, and then the price quickly slides.

This is how many of these trade alert services guarantee their own profits.

Therefore, the FURU makes money on these fast trades and the constant cycle of subscription payments.

The more hype and followers they generate, the more they charge. Some FURU’s charge between $200 and $999 a month. They’re banking some serious coin!

#A constant stream of new targets

An illustrative conversation between FURU and stock trader:

FURU: This stock looks hot! I’m all in. I made $X last week on {insert_hot_stocks} – copy my trading patterns and become a millionaire!

Stock Trader: I copied your trades exactly, but I’ve lost a fortune; what went wrong?!?

FURU: You didn’t get out in time, you should’ve listened!

Stock Trader: I did listen! Stupidly it seems. I’ve now lost my life savings.

FURU: Silence…

As the trade alerts are usually based on some level of technical analysis, those early followers do stand a chance to make a quick buck, if they’re quick to ride the wave and cash out early. Therefore, there’s plenty of followers willing to sing the praises of the service.

Meanwhile, the losers are often too ashamed or embarrassed to report their losses because they believe they’ve done something wrong.

With newcomers arriving on the scene daily, there’s a constant stream of new members to bring into the service. So, as some lose and leave, newcomers join in, lured by images of Lamborghinis, private jets, Rolex watches, and stacks of money.

#Become a stock Guru without a Furu

Becoming a successful trader/investor is far from easy. If it was, everyone would do it. But with hard work and determination, it is possible. That’s the great thing about the stock market. It’s accessible to anyone and gives ordinary people a chance at generating extraordinary fortunes.

While there’s a lot to learn, it’s accessible to anyone willing to put in the work.

Unfortunately, the pandemic opened the floodgates to many more FURU’s operating on the back of an easy-ride bull run in the US capital markets.

Don’t be tempted by a smooth-talking FURU and the flashy lifestyle. They can only afford to live that way (if it’s even real) thanks to the subscription payments coming from their bogus services.

The text message and email alerts may work for the followers occasionally, but when it goes wrong, it can go wrong big.

Picking stocks with a process, even if it’s a random selection, will eventually bring a few winners, it’s not advised, but you’ll save money on subscription payments.

A safer way is to study hard, find an investing style that works for you and stick with it.

Many millionaires have been made by patiently investing in businesses likely to stand the tests of time. Thanks to the compounding rewards of dividend payments, long-term investing has rewarded many fearful of the volatility of day trading.

There are many roads to riches but beware of FURU’s along the way.