Markets move. So does wealth. The world’s richest people can gain or lose billions in a single trading day, and that shift often reflects broader trends in tech, retail, energy, or other dominant sectors. But the names at the top don’t change much. The top ten richest people in the world tend to hold their spots through long-term exposure to the companies and industries driving real growth. Their net worth may swing, along with their position in the top ten ranking, but their influence remains steady.

What’s behind the fluctuating numbers? Forbes’ real-time billionaire list1 updates net worth as markets move, revealing which sectors are gaining momentum - and which ones are losing steam. When Oracle rises, Ellison gains. When Meta falls, Zuckerberg drops. These aren’t isolated moves. They echo broader sentiment in public markets.

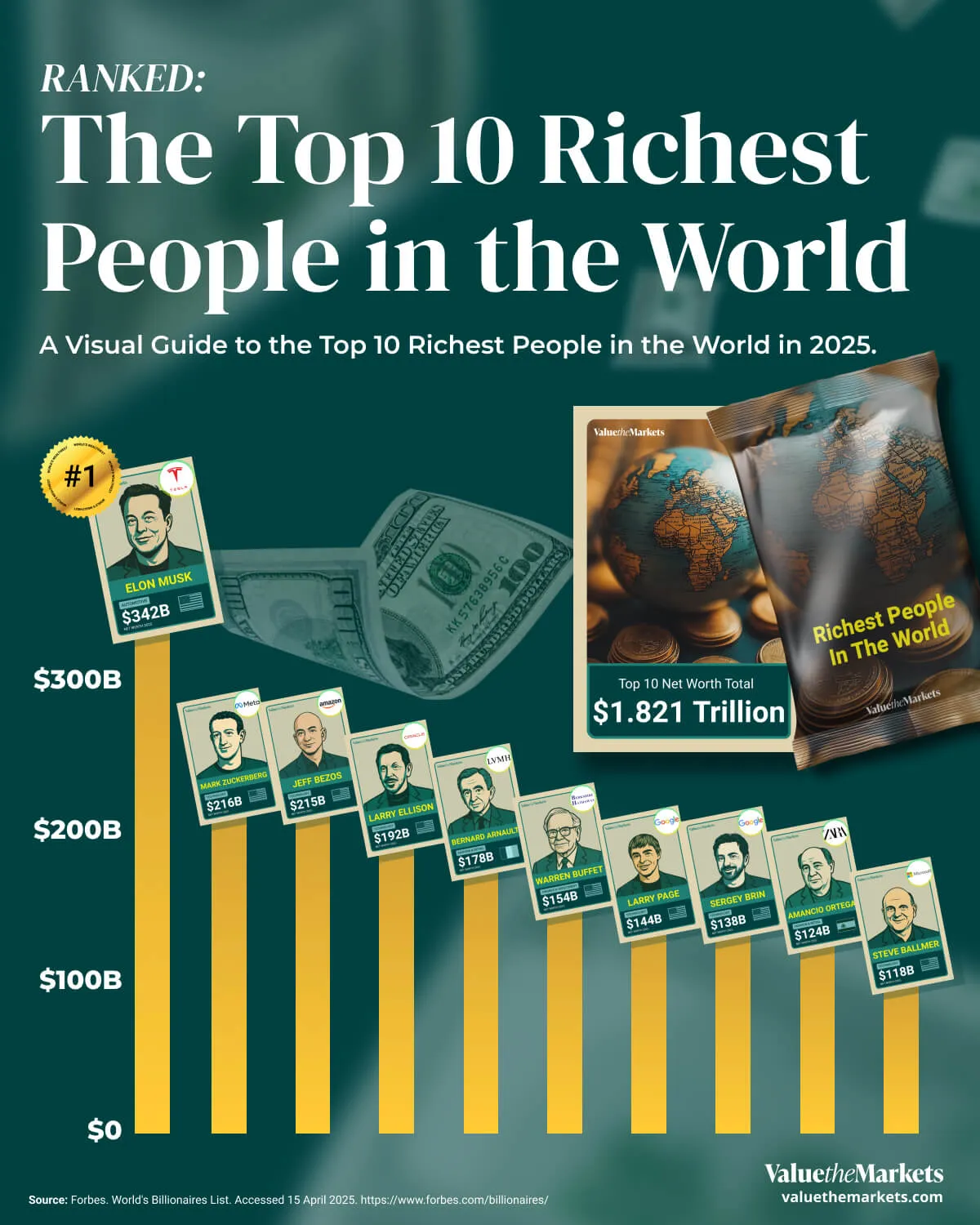

#Top 10 Richest in 2025

| Rank | Name | Net Worth (USD) | Age | Country | Industry | Company/Companies |

| 1 | Elon Musk | $342 billion | 53 | United States | Automotive, Space | Tesla, SpaceX, xAI |

| 2 | Mark Zuckerberg | $216 billion | 40 | United States | Technology | Meta Platforms |

| 3 | Jeff Bezos | $215 billion | 61 | United States | E-commerce, Aerospace | Amazon, Blue Origin |

| 4 | Larry Ellison | $192 billion | 80 | United States | Software | Oracle Corporation |

| 5 | Bernard Arnault & family | $178 billion | 76 | France | Fashion & Retail | LVMH |

| 6 | Warren Buffett | $154 billion | 94 | United States | Finance & Investments | Berkshire Hathaway |

| 7 | Larry Page | $144 billion | 52 | United States | Technology | Alphabet Inc. (Google) |

| 8 | Sergey Brin | $138 billion | 51 | United States | Technology | Alphabet Inc. (Google) |

| 9 | Amancio Ortega | $124 billion | 89 | Spain | Fashion | Inditex (Zara) |

| 10 | Steve Ballmer | $118 billion | 69 | United States | Technology | Microsoft |

#What Their Wealth Tells You

These fortunes didn’t come from luck. Each reflects long-term bets on durable growth, recurring revenue, and strategic control of capital.

Elon Musk continues to top the list thanks to Tesla, SpaceX, and a broad footprint across EVs, space, AI, and energy infrastructure. Musk’s diversified exposure across multiple tech-heavy industries keeps him near the top, even when individual holdings wobble.

Jeff Bezos still holds a large Amazon stake. His net worth rises and falls with e-commerce, cloud networking services, and logistics trends.

Mark Zuckerberg shifted Meta’s focus from the metaverse to AI. The result: a stock rebound that helped recover billions in value.

Larry Ellison benefits from Oracle’s steady move into enterprise cloud software. Predictable cash flow still wins.

Warren Buffett built wealth through the disciplined ownership of profitable, low-turnover businesses. His portfolio is public, and many investors copy it.

Bernard Arnault tracks global luxury demand. His net worth reflects the health of the high-end consumer, especially in China and Europe. A strong dollar or weakening demand in Asia can pull this number down fast.

Larry Page and Sergey Brin retain major stakes in Alphabet. Google invests heavily in AI, infrastructure, and advertising optimization, and their wealth rides that wave.

Amancio Ortega proves that retail still matters. Ortega founded Zara and controls Inditex, one of the most profitable fashion retailers globally. He’s a reminder that you don’t have to be in tech to build generational wealth - global distribution and cost control also pay off.

Steve Ballmer, former Microsoft CEO, holds one of the largest Microsoft positions of any individual. As the company expands its AI and cloud footprint, his wealth moves with it.

#Why It Matters

Tracking billionaire wealth isn't about celebrity, it’s about direction. These individuals reflect where capital is flowing, where margins are growing, and where the next cycle may take shape.

If more energy or healthcare leaders start appearing in the top 10, that shift will signal a deeper realignment in global markets.

When tech leaders lose ground, it's often tied to broader corrections in valuation or profitability, not just isolated stock drops. Watching these moves gives you a live read on which business models are still compounding and which ones are starting to stall.

Tech still dominates. So do recurring revenues, defensible moats, and disciplined capital reinvestment. Investors who follow the money, not the headlines, will always have an edge.