Touchstone Exploration (LSE:TXP)

Touchstone Exploration has raised $30 million in an oversubscribed placing to make the most of its enormous natural gas finds in Trinidad.

The rising star placed 24,291,866 shares at 95p in a joint UK/Canadian placing to institutional and other investors at a single-digit discount to its London share price.

Continued upward revisions of the natural gas finds at Touchstone’s fingertips in the Ortoire Block mean there is a much larger opportunity at play in the Caribbean than even CEO Paul Baay had previously thought possible.

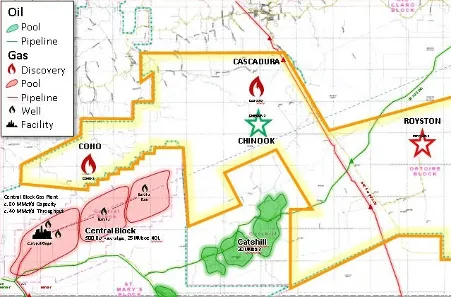

Drilling has already begun at three exploration wells — Coho, Cascadura and Chinook — with an extra Cascadura Deep well spudding ahead of schedule last week. A fifth exploration well, Royston, is the next major target, and at 11,500ft it will go deeper than any of the previous wells.

Hotly anticipated results from Chinook-1 in October saw the drill campaign reveal 600ft of net gas pay in the Herrera sands, with “significant hydrocarbon accumulations” far above expectations. The well encountered 2,000ft of turbidite deposits and almost 1,500ft of developed sands.

Chinook became Touchstone’s third major discovery at Ortoire, and shares exploded by almost a third as the news filtered through the markets.

Selling on

Touchstone is in advanced negotiations with the Trinidad and Tobago government to sell every cubic foot of natural gas produced from the Ortoire block to the state-run National Gas Company, with a deal expected to be announced before the end of the year.

In an update on Tuesday, Baay noted how Ortoire “has consistently exceeded our expectations”, adding that the fundraise would “allow us to continue our exploration and development activities we have planned….as we seek to bring our existing natural gas discoveries onto production and drill further prospective targets.”

“We are delighted with the support we have received from new and existing investors,” Baay added.

London broker Shore Capital and Canadian giant Canaccord Genuity (TSX:CF) acted as joint bookrunners in the UK, raising £23.1 million, while Canaccord were the sole bookrunner in Canada, raising C$39.8 million.

The funds will help to pay for the installation of surface facilities at Cascadura, the full drill campaign at Cascadura Deep, as well as supporting the exciting plans for Royston.

Baay delivers again

Ortoire is just one part of a multi-stage re-rate process that has seen Touchstone fulfil its potential over and over.

Touchstone signed a six-year exploration and production contract with the Trinidadian government in 2014 to explore more than 44,000 acres on the east side of the island.

The firm was admitted to AIM in 2017 at a share price of 7.25p, and at that point was already one of Trinidad’s largest oil producers with production rates of 1,300 boepd. Petroleum revenues jumped by 30% that year to $32m, up from £24m in 2016, and Touchstone became profitable at a PLC level.

Less than six months later, the firm hit 2,000boepd targets, with its share price at 19.3p.

An independent report by consultant GLJ in early 2019 then revealed the “monumental” potential to the east of Touchstone’s already producing wells. This was the Ortoire block.

With an NPV10 first slated to hit as high as $86.8 million, then $102 million, then much more, we can see why Baay has been hyperfocused on making Ortoire come to life.

Data from 2019 showed that Coho-1, the first well on the Ortoire block to spud, had a more than 73% chance to produce peak flows of 1,965 boepd equivalent over nine years. By itself! The transformational element here is easy to see.

Drill results from Coho, reported in November 2019, smashed expectations. It tested a flow rate equivalent to 2,917 boepd. Coho would “materially contribute to our near-term growth,” Touchstone’s COO James Shipka noted at the time.

The desperate shortfalls in Trinidad’s LNG market have also presented a massive opportunity for Touchstone.

In the three years since its AIM listing, Touchstone has delivered incredible returns for investors, but the real jewel in the crown has yet to be fully factored into today’s share price.

Cascadura, the second of the Ortoire block wells to be drilled, was the real game-changer. A first stage production test was originally just to test for a potential oil zone but hit a major gas discovery — the best possible outcome for Touchstone. A second round of well tests in March 2020 delivered combined average production of over 10,600 boepd.

Touchstone sidetracked Cascadura not once but twice for Cascadura-1ST1 and 1-ST2, and the company is now evaluating 2021 production potential.

Wireline logs from Royston, the fifth well on the Ortoire block, indicate 700ft of gas — more than Chinook — but the well has never been tested. It lies on precisely the same geological trend as Coho-1 and Cascadura-1ST1.

Given that Touchstone is already an established operator in Trinidad, any discoveries will be simple to commercialise.

TXP shares have already three-bagged since January on the strength of its potential haul of natural gas. But the real prize appears to be in holding out for the true company-making event, with production plans well on the way for 2021.